Dollar General 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of increasing gross margin and primarily resulted from the Company’s ability to lower its product costs through effective

purchasing methods and the general lack of inflation during the period. The Company did not benefit from a comparable

adjustment in 2003 primarily because the LIFO reserves in certain inventory departments had been reduced to nominal

amounts, or zero, in 2002 or prior years.

•An increase in markdowns of 14 basis points. The increase in markdowns was due principally to increased Christmas-

related markdowns compared to those the Company had taken in the past and, to a lesser extent, markdowns taken to

assist with the sale of both discontinued and slower moving apparel items.

The slight decline in the gross profit rate in 2002 as compared with 2001 was due primarily to an increase in the Company’s shrink-

age provision from 2.90% in 2001 to 3.52% in 2002, calculated using retail dollars as a percentage of sales. As discussed above, the

Company has taken several actions to combat shrink and continues to focus on this effort. The Company improved its initial mar-

gin on inventory purchases in all four of its major categories in 2002 as compared against 2001, which partially offset the increase

in the shrinkage provision. However, the continued shift in the Company’s sales mix to lower margin highly consumable items

noted above limited the year over year increase in the total initial margin rate to 7 basis points. The Company recorded an $8.9

million adjustment and a $3.5 million adjustment in the fourth quarters of 2002 and 2001, respectively, pertaining to its LIFO valu-

ation, which had the effect of increasing gross profit in both years. These adjustments were primarily the result of the Company’s

ability to lower its product costs through effective purchasing methods and the general lack of inflation.

Distribution and transportation costs decreased by approximately seven and six basis points, respectively, as a percentage of sales

in 2002 as compared to 2001. The reduction in distribution costs as a percentage of sales was due primarily to occupancy and

depreciation expenses that grew at a rate less than the sales increase, while the reduction in transportation costs as a percentage

of sales was due primarily to freight expenses that grew at a rate less than the sales increase. Occupancy costs represented a

decline of approximately five basis points as a percentage of sales in 2002 as compared to 2001, due primarily to reduced rental

and real property tax expenses as a percentage of sales. Depreciation expenses represented a decline of approximately three basis

points as a percentage of sales in 2002 as compared to 2001, due primarily to the fact that distribution center depreciation is rela-

tively fixed in comparison with the growth in the Company’s sales base. Factors contributing to the reduction in freight expense as

a percentage of sales in 2002 include lower fuel costs during the first half of the year and an effective freight revenue sharing pro-

gram whereby the Company picks up product directly from its vendors as opposed to having it shipped, each of which resulted in

a decline of approximately four basis points as a percentage of sales in 2002 as compared to 2001.

Selling, General and Administrative ("SG&A") Expense. The increase in SG&A expense as a percentage of sales, excluding restate-

ment-related expenses (primarily professional fees), in 2003 as compared with 2002 was due to a number of factors including but

not limited to increases in the following expense categories that were in excess of the 12.6 percentage increase in sales: store labor

(increased 14.6%) primarily due to increases in store training-related costs; the cost of workers’ compensation and other insurance

programs (increased 29.8%) primarily due to an increase in medical inflation costs experienced by the Company compared to pre-

vious years; store occupancy costs (increased 15.8%) primarily due to rising average monthly rentals associated with the Company’s

leased store locations; and higher bonus expense (increased 34.4%) related to the Company’s financial performance during 2003.

The increase in SG&A expense as a percentage of sales, excluding restatement-related expenses, in 2002 as compared with 2001

was due to a number of factors including but not limited to increases in the following expense categories that were in excess of the

14.6 percentage increase in sales: store labor (increased 21.1%) primarily due to continued efforts to improve store conditions by

both increasing the total number of hours worked in the stores and the average wage of the store employees; the cost of workers’

compensation and other insurance programs (increased 54.2%) primarily due to higher average medical costs relating to worker’s

compensation claims and increased premiums for directors’ and officers’ insurance; store occupancy costs (increased 18.6%) pri-

marily due to rising common area maintenance costs associated with leased store locations; and store repairs and maintenance

(increased 44.5%) primarily due to increased floor cleaning expenses and higher fixture repair costs.

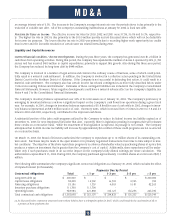

Penalty and Litigation Settlement Proceeds. As more fully discussed in Note 7 to the Consolidated Financial Statements, the

Company accrued $10.0 million in 2003 with respect to a civil penalty related to its agreement in principle with the Securities and

Exchange Commission ("SEC") staff to settle the matters arising out of the Company’s financial restatement. In 2002, the Company

recorded $29.5 million in net litigation settlement proceeds, which amount included $29.7 million in insurance proceeds associat-

ed with the settlement of the restatement-related class action and shareholder derivative litigation offset by a $0.2 million settle-

ment of a shareholder class action opt-out claim related to the Company’s restatement.

Interest Expense, Net. The decrease in net interest expense over the period from 2001 to 2003 is due primarily to debt reduction

achieved during 2003 and 2002. The average daily total debt outstanding over the past three years was as follows: 2003 - $301.5

million at an average interest rate of 8.6%; 2002 - $575.7 million at an average interest rate of 6.6%; and 2001 - $738.8 million at

M D & A

14