Dollar General 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

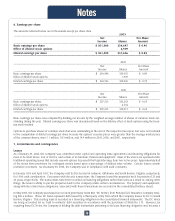

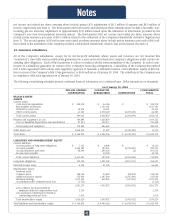

6. Earnings per share

The amounts reflected below are in thousands except per share data.

2003

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Net Per Share

Income Shares Amount

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Basic earnings per share $ 301,000 334,697 $ 0.90

Effect of dilutive stock options 2,939

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Diluted earnings per share $ 301,000 337,636 $ 0.89

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

2002

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Net Per Share

Income Shares Amount

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Basic earnings per share $ 264,946 333,055 $ 0.80

Effect of dilutive stock options 1,995

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Diluted earnings per share $ 264,946 335,050 $ 0.79

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

2001

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Net Per Share

Income Shares Amount

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Basic earnings per share $ 207,513 332,263 $ 0.63

Effect of dilutive stock options 2,754

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Diluted earnings per share $ 207,513 335,017 $ 0.62

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Basic earnings per share was computed by dividing net income by the weighted average number of shares of common stock out-

standing during the year. Diluted earnings per share was determined based on the dilutive effect of stock options using the treas-

ury stock method.

Options to purchase shares of common stock that were outstanding at the end of the respective fiscal year, but were not included

in the computation of diluted earnings per share because the options’ exercise prices were greater than the average market price

of the common shares, were 5.1 million, 18.3 million, and 14.4 million in 2003, 2002, and 2001, respectively.

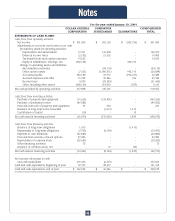

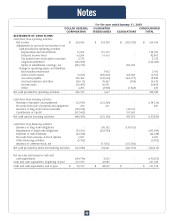

7. Commitments and contingencies

Leases

As of January 30, 2004, the Company was committed under capital and operating lease agreements and financing obligations for

most of its retail stores, four of its DCs, and certain of its furniture, fixtures and equipment. Most of the stores are operated under

traditional operating leases that include renewal options for periods that typically range from two to five years. Approximately half

of the stores have provisions for contingent rentals based upon a percentage of defined sales volume. Certain leases contain

restrictive covenants. As of January 30, 2004, the Company was in compliance with such covenants.

In January 1999 and April 1997, the Company sold its DCs located in Ardmore, Oklahoma and South Boston, Virginia, respectively,

for 100% cash consideration. Concurrent with the sale transactions, the Company leased the properties back for periods of 23 and

25 years, respectively. The transactions have been recorded as financing obligations rather than sales as a result of, among other

things, the lessor’s ability to put the properties back to the Company under certain circumstances. The property and equipment,

along with the related lease obligations, associated with these transactions are recorded in the consolidated balance sheets.

In May 2003, the Company purchased two secured promissory notes (the "DC Notes") from Principal Life Insurance Company total-

ing $49.6 million. These DC Notes represent debt issued by a third party entity from which the Company leases its DC in South

Boston, Virginia. This existing lease is recorded as a financing obligation in the consolidated financial statements. The DC Notes

are being accounted for as "held to maturity" debt securities in accordance with the provisions of SFAS No. 115. However, by

acquiring these DC Notes, the Company is holding the debt instruments pertaining to its lease financing obligation and, because a

Notes

36