Dollar General 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Serving

Others

Dollar General Corporation

Annual Report for the year ended January 30, 2004

Team On A Mission...

Serving

Others

Table of contents

-

Page 1

Dollar General Corporation Annual Report for the year ended January 30, 2004 Team On A Mission... Serving Others -

Page 2

... prices. The mission statement for each of the Company's 57,800 employees is "Serving Others: for customers, a better life; for shareholders, a superior return; for employees, respect and opportunity." Dollar General's stock was first offered to the public in 1968 and has been listed on the New York... -

Page 3

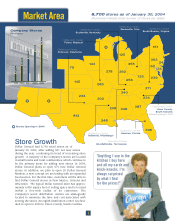

... Distribution Center Indianola, Mississippi Distribution Center Alachua, Florida • 396 Store Growth Dollar General had 6,700 retail stores as of January 30, 2004, after adding 587 net new stores during the year, continuing its trend of increasing store growth. A majority of the Company's stores... -

Page 4

... 4.0%. We opened 673 new Dollar General stores, including two Dollar General Market stores, exceeding our goal of 650 new stores, and grew net store selling square footage by 10%. Net income increased 13.6%. However, when you exclude restatement-related items, it grew 24.1%. Operating profit margin... -

Page 5

... stores in Michigan, New York and New Jersey within the past four years. In 2004, we plan to open stores in New Mexico, Arizona and Wisconsin for the first time. Finally we continue to test new formats that will allow us to present variations of our model and increase the breadth of our product... -

Page 6

... Valley , DG DG ® Guarantee® Guarantee a n d and American American ®®. For the Value . Value vide convenience and value to customers by offering consumable basics, items that are frequently used and replenished, such as food, snacks, health and beauty aids and cleaning supplies. Dollar General... -

Page 7

... price point for the extreme value-conscious customer. Refrigerated items. Many Dollar General stores are equipped with refrigerated coolers, filled with frequently purchased items including milk, dairy products, eggs, packaged luncheon meats and selected frozen foods, including ice cream, pizzas... -

Page 8

... Seasonal Home Products Basic Clothing Sales By Category Dollar General stores primarily serve the consumable basics needs of low- or middle-income customers, many of whom are on fixed incomes. According to ACNielsen's Homescan® data, in 2003 approximately 48% of the Company's customers lived in... -

Page 9

...but on the flow of product from vendor to distribution center to store shelf. success of their stores. Dollar General recognizes the importance of hiring the right people and giving them the necessary support and training to succeed. Today, we train every new store manager with the necessary skills... -

Page 10

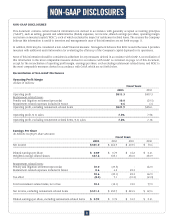

...general and administrative (SG&A) expenses, net income, diluted earnings per share, operating margin and return on invested capital ("ROIC"), each of which excludes the impact of restatement-related items. The reasons the Company believes this information is useful to investors and management's uses... -

Page 11

...excluding restatement-related items 13.6% 12.5 a) The Company believes that the most directly comparable ratio calculated solely using GAAP measures is the ratio of net income to the sum of average long-term obligations, including current portion, and average shareholders' equity. This ratio was 17... -

Page 12

... in Ardmore, Oklahoma and South Boston, Virginia and beginning construction of the new distribution center in South Carolina; • Implementing a merchandising data warehouse; • Maintaining an acceptable in-stock level on all core items as well as for its 100 fastest moving items; • A store work... -

Page 13

... of new store locations and merchandising strategies. • Operating margin rate (operating profit divided by net sales) which is an indicator of the Company's success in leveraging its fixed costs and managing its variable costs. • Return on invested capital (numerator - net income plus interest... -

Page 14

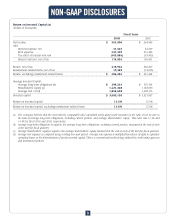

...26 Net income $ 301.0 $ 264.9 $ 207.5 $ 36.1 13.6% $ 57.4 27.7% % of net sales 4.38% 4.34% 3.90 Diluted earnings per share $ 0.89 $ 0.79 $ 0.62 $ 0.10 12.7% $ 0.17 27.4% Weighted average diluted shares 337.6 335.1 335.0 2.6 0.8 Restatement-related items: Penalty and litigation settlement proceeds... -

Page 15

... seasonal and home product items; a 31% increase in imported purchases, which carry higher than average mark-ups; and a 72% increase in various performance-based vendor rebates. • A reduction in the Company's shrink provision from 3.52% in 2002 to 3.05% in 2003, calculated using retail dollars as... -

Page 16

... profit in both years. These adjustments were primarily the result of the Company's ability to lower its product costs through effective purchasing methods and the general lack of inflation. Distribution and transportation costs decreased by approximately seven and six basis points, respectively... -

Page 17

... a number of legal actions and claims in the ordinary course of business, some of which could potentially result in a material cash settlement. In addition, the Company is involved in a collective action pending in the United States District Court for the Northern District of Alabama. If the Company... -

Page 18

... 76 stores. Systems-related projects in 2003 included $5.9 million for point-of-sale and satellite technology and $3.1 million related to debit/credit/EBT technology. Distribution and transportation expenditures in 2003 include $19.1 million at the Ardmore, Oklahoma and South Boston, Virginia DCs... -

Page 19

... equipment for 695 new stores, which includes 20 new Dollar General Market stores; the construction of the new DC in Union County, South Carolina; expansions and equipment upgrades of the Company's DCs in Ardmore, Oklahoma and South Boston, Virginia; the rollout of coolers into approximately 2,850... -

Page 20

.... Self-Insurance Liability. The Company retains a significant portion of the risk for its workers' compensation, employee health insurance, general liability, property loss and automobile coverage. These costs are significant primarily due to the large employee base and number of stores. Provisions... -

Page 21

... rules and will pay a $10 million nondeductible civil penalty. The agreement with the SEC staff is subject to final approval by the SEC and the court in which the SEC's complaint is filed. The Company has accrued $10 million with respect to the penalty in its financial statements for the year ended... -

Page 22

... attractive pricing with the consequence that its net sales or profit margins would be reduced. The Company may also face difficulty in obtaining needed inventory from its vendors because of interruptions in production or for other reasons, which would adversely affect the Company's business. The... -

Page 23

... upon the ability to replenish depleted inventory through deliveries to its DCs from vendors, and from the DCs to its stores by various means of transportation, including shipments by air, sea and truck on the roads and highways of the United States. The "driver hours of service" regulations adopted... -

Page 24

...estimated at approximately $265.4 million (net of the fair value of a note receivable on the South Boston, Virginia DC of $48.9 million, as further discussed in Note 7 to the Consolidated Financial Statements) and $287.0 million, respectively, based on the estimated market value of the debt at those... -

Page 25

... of Dollar General Corporation Goodlettsville, Tennessee We have audited the accompanying consolidated balance sheets of Dollar General Corporation and subsidiaries as of January 30, 2004 and January 31, 2003, and the related consolidated statements of income, shareholders' equity, and cash flows... -

Page 26

... Sheets CONSOLIDATED BALANCE SHEETS (Dollars in thousands except per share amounts) January 30, 2004 January 31, 2003 ASSETS Current assets: Cash and cash equivalents $ 398,278 $ 121,318 Merchandise inventories 1,157,141 1,123,031 Deferred income taxes 30,413 33,860 Other current assets 66,383... -

Page 27

... 28.36 Selling, general and administrative 1,496,866 21.78 1,296,542 21.25 1,135,801 21.34 Penalty and litigation settlement proceeds 10,000 0.15 (29,541) (0.48 Operating profit 511,263 7.44 457,265 7.50 373,611 7.02 Interest expense, net 31,503 0.46 42,639 0.70 45,789 0.86 Income before taxes on... -

Page 28

... income 266,825 Cash dividends, $0.13 per common share, net of accruals (31,991) (31,991) Issuance of common stock under stock incentive plans (710,000 shares) 355 4,666 5,021 Tax benefit from exercise of options 2,372 2,372 Purchase of common stock by employee deferred compensation trust, net... -

Page 29

... 152,399 134,959 122,967 Deferred income taxes 19,850 82,867 7,743 Tax benefit from stock option exercises 14,565 2,372 5,819 Litigation settlement (162,000) Change in operating assets and liabilities: Merchandise inventories (34,110) 7,992 (118,788) Other current assets (20,684) 12,566 (13,540... -

Page 30

... has distribution centers ("DCs") in Scottsville, Kentucky; Ardmore, Oklahoma; South Boston, Virginia; Indianola, Mississippi; Fulton, Missouri; Alachua, Florida and Zanesville, Ohio. The Company purchases its merchandise from a wide variety of suppliers. Approximately 11% of the Company's purchases... -

Page 31

..., utility and security deposits, life insurance policies and goodwill. Vendor rebates The Company records vendor rebates, primarily consisting of new store allowances and volume purchase rebates, when realized. The rebates are recorded as a reduction to inventory purchases, at cost, which has... -

Page 32

... The Company has a shareholder-approved stock incentive plan under which stock options, restricted stock, restricted stock units and other equity-based awards may be granted to officers, directors and key employees. Stock options currently are granted under this plan at the market price on... -

Page 33

...cost for the Company's stock-based compensation plans been determined based on the fair value at the grant date for awards under these plans consistent with the methodology prescribed under SFAS No. 123 (with compensation expense amortized ratably over the applicable vesting periods), net income and... -

Page 34

... income tax returns. Deferred income tax expense or benefit is the net change during the year in the Company's deferred income tax assets and liabilities. Management estimates The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted... -

Page 35

.... Amortization of capital lease assets is included in depreciation expense. 3. Accrued expenses and other Accrued expenses and other consist of the following: (In thousands) 2003 2002 Compensation and benefits $ 78,374 $ 63,868 Insurance 97,104 73,528 Taxes (other than taxes on income) 35,859 29... -

Page 36

..., management believes that it is more likely than not that the results of operations will generate sufficient taxable income to realize the deferred tax assets after giving consideration to the valuation allowance. The Company estimates its contingent income tax liabilities based on its assessment... -

Page 37

... and the all-in drawn margin under the base rate option was the base rate plus 125 basis points. The Credit Facility is secured by approximately 400 of the Company's retail stores, its headquarters and two of its distribution centers which had a net book value of approximately $329.8 million at... -

Page 38

... 30, 2004, the Company was in compliance with such covenants. In January 1999 and April 1997, the Company sold its DCs located in Ardmore, Oklahoma and South Boston, Virginia, respectively, for 100% cash consideration. Concurrent with the sale transactions, the Company leased the properties back for... -

Page 39

...value of net minimum lease payments Less: purchased promissory notes Less: current portion, net Long-term portion 44,095 (5,867) _____ 38,228 _____ 38,228 (15,902) _____ $ 22,326 193,745 (100,559) _____ 93,186 (49,132) _____ 44,054 (768) _____ $ 43,286 948,984 _____ Capital leases were discounted... -

Page 40

... District of Alabama to commence a collective action against the Company on behalf of current and former salaried store managers. The complaint alleges that these individuals were entitled to overtime pay and should not have been classified as exempt employees under the Fair Labor Standards Act... -

Page 41

... deferral plan for a select group of management and highly compensated employees. The supplemental retirement plan is a noncontributory defined contribution plan with annual Company contributions ranging from 2% to 12% of base pay plus bonus depending upon age plus years of service and salary level... -

Page 42

... the grant date. Pro forma information regarding net income and earnings per share, as disclosed in Note 1, has been determined as if the Company had accounted for its employee stock-based compensation plans under the fair value method of SFAS No. 123. The fair value of options granted during 2003... -

Page 43

... the exercise of stock options (net of the strike price of such options) and approximately $0.8 million represented the value of performance-based bonuses received by Mr. Turner in April 1999 and April 2000. Mr. Turner voluntarily paid such amounts to the Company because the options vested and the... -

Page 44

... utilization of information provided by the Company's new item level perpetual inventory system. The third quarter 2002 net income and related per share amounts above include pretax insurance proceeds of $25.2 million related to the settlement of the Company's shareholder derivative litigation (see... -

Page 45

...31, 2003 DOLLAR GENERAL GUARANTOR CONSOLIDATED CORPORATION SUBSIDIARIES ELIMINATIONS TOTAL BALANCE SHEET: ASSETS Current assets: Cash and cash equivalents $ 72,799 $ 48,519 $ $ 121,318 Merchandise inventories 1,123,031 1,123,031 Deferred income taxes 8,937 24,923 33,860 Other current assets 19,004... -

Page 46

... TOTAL STATEMENTS OF INCOME: Net sales $ 130,152 $ 6,100,404 $ (130,152) $ 6,100,404 Cost of goods sold 4,376,138 4,376,138 Gross profit 130,152 1,724,266 (130,152) 1,724,266 Selling, general and administrative 114,903 1,311,791 (130,152) 1,296,542 Proceeds from litigation settlement (29... -

Page 47

...132,438 152,399 Deferred income taxes (2,102) 21,952 19,850 Tax benefit from stock option exercises 14,565 14,565 Equity in subsidiaries' earnings, net (302,154) 302,154 Change in operating assets and liabilities: Merchandise inventories (34,110) (34,110) Other current assets (7,323) (1,006,071) 992... -

Page 48

...Deferred income taxes 63,204 19,663 82,867 Tax benefit from stock option exercises 2,372 2,372 Litigation settlement (162,000) (162,000) Equity in subsidiaries' earnings, net (253,720) 253,720 Change in operating assets and liabilities: Merchandise inventories 7,992 7,992 Other current assets (5,605... -

Page 49

... 107,999 122,967 Deferred income taxes (6,892) 14,635 7,743 Tax benefit from stock option exercises 5,819 5,819 Equity in subsidiaries' earnings, net (207,692) 207,692 Change in operating assets and liabilities: Merchandise inventories (118,788) (118,788) Other current assets 250 (307,082) 293,292... -

Page 50

..., Inc. David A. Perdue Chairman and CEO - Dollar General Corporation James D. Robbins (1) Retired Partner - PricewaterhouseCoopers L.L.P. James L. Clayton (2) Chairman and CEO - FSB Bank Shares, Inc. Dennis C. Bottorff (3)*(4) Chairman - Council Ventures David M. Wilds (3)(4) Managing Partner - 1st... -

Page 51

... Jeffrey R. Sims Vice President, Distribution Tony V. Davis Vice President, Transportation Stonie R. O'Briant Executive Vice President, Merchandising, Marketing & Strategic Planning (back row - left to right) J. Bruce Ash Vice President, Information & Administrative Services Richard L. McNeely Vice... -

Page 52

... Goodlettsville, Tennessee 37072 (615) 855-4000 DIRECT STOCK PURCHASE/ DIVIDEND REINVESTMENT PLAN Enrollment materials are available on our Web site, www.dollargeneral.com, or by calling (888) 266-6785. The Dollar General Direct Stock Purchase Plan is administered by the Company's transfer agent... -

Page 53

... better life. During 2003, the Dollar General Literacy Foundation awarded grants to 110 non-profit literacy providers serving more than 40,000 individuals and families. Our employees, customers and vendors contributed more than $1.9 million dollars to the advancement of literacy through our in-store... -

Page 54

Dollar General Corporation 100 Mission Ridge Goodlettsville, TN 37072 www.dollargeneral.com