DIRECTV 2002 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

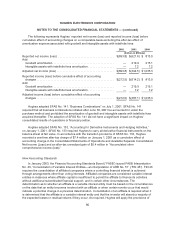

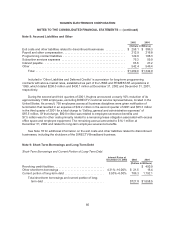

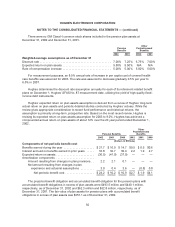

The combined income tax benefit was different than the amount computed using the U.S. federal

statutory income tax rate for the reasons set forth in the following table:

2002 2001 2000

(Dollars in Millions)

Expected refund at U.S. federal statutory income tax rate .............. $(99.9) $(346.4) $(285.4)

Research and experimentation tax benefits and resolution of tax

contingencies ................................................ (98.0) (30.0) (80.9)

Extraterritorial income exclusion and foreign sales corporation tax benefit . (34.8) (37.1) (32.8)

U.S. state and local income tax benefit ............................. (6.5) (20.9) (26.6)

Tax basis differences attributable to equity method investees ........... 14.1 (29.6) (81.2)

Discontinuation of DIRECTV Broadband business .................... 27.9 — —

Minority interests in losses of partnership ........................... — 33.9 27.8

Non-deductible goodwill amortization ............................... — 46.3 40.3

Foreign losses and taxes, net of credits ............................ 100.7 56.8 31.6

Other......................................................... 2.1 1.4 1.1

Total income tax benefit ...................................... $(94.4) $(325.6) $(406.1)

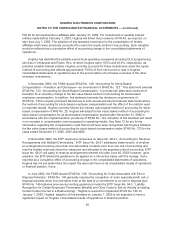

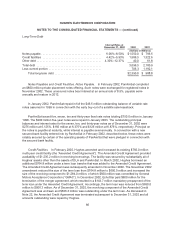

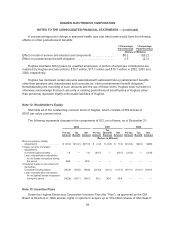

Temporary differences and carryforwards which gave rise to deferred tax assets and liabilities at

December 31 were as follows:

2002 2001

Deferred

Tax

Assets

Deferred

Tax

Liabilities

Deferred

Tax

Assets

Deferred

Tax

Liabilities

(Dollars in Millions)

Accruals and advances ............................. $ 295.9 $ 316.5

Customer deposits, rebates and commissions .......... 146.1 $ 158.1 172.3 $ 170.7

State taxes ....................................... — 2.6 23.2 —

GainonPanAmSatmerger .......................... — 171.6 — 176.4

Depreciationandamortization........................ 74.8 1,143.2 — 1,065.1

Net operating loss and tax credit carryforwards .......... 405.3 — 351.6 —

Discontinuation of DIRECTV Broadband business ....... 104.1 — — —

Programming contract liabilities ...................... 168.5 — 227.0 —

Unrealized gains and losses on securities .............. 1.4 — — 130.5

Other ............................................ 72.1 91.0 72.2 135.0

Subtotal .......................................... 1,268.2 1,566.5 1,162.8 1,677.7

Valuation allowance ................................ (185.2) — (112.7) —

Total deferred taxes ............................ $1,083.0 $1,566.5 $1,050.1 $1,677.7

No income tax provision has been made for the portion of undistributed earnings of foreign

subsidiaries deemed permanently reinvested that amounted to approximately $76.9 million and

$62.5 million at December 31, 2002 and 2001, respectively. Repatriation of all accumulated earnings

would have resulted in tax liabilities of $26.9 million in 2002 and $21.9 million in 2001.

At December 31, 2002, Hughes has $126.7 million of deferred tax assets relating to foreign

operating loss carryforwards expiring in varying amounts between 2003 and 2007. A valuation

allowance was provided for all foreign operating loss carryforwards. At December 31, 2002, Hughes

89