DIRECTV 2002 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

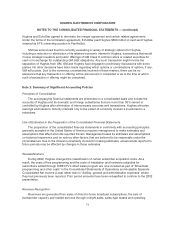

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

impact of changes in the fair value of recognized assets, liabilities, and unrecognized firm

commitments, or the variability of cash flows associated with forecasted transactions in accordance

with internal risk management policies. Changes in fair value of designated, qualified and effective fair

value hedges are recognized in earnings as offsets to the changes in fair value of the related hedged

items. Changes in fair value of designated, qualified and effective cash flow hedges are deferred and

recorded as a component of OCI until the hedged transactions occur and are recognized in earnings.

The ineffective portion and changes related to amounts excluded from the effectiveness assessment of

a hedging derivative’s change in fair value are immediately recognized in the Consolidated Statements

of Operations and Available Separate Consolidated Net Income (Loss) in “Other, net.” Hughes

assesses, both at the inception of the hedge and on an on-going basis, whether the derivatives are

highly effective. Hedge accounting is prospectively discontinued when hedge instruments are no longer

highly effective.

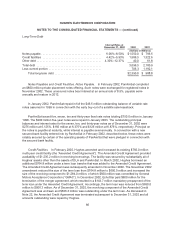

The net deferred loss from effective cash flow hedges net of taxes in OCI of $1.2 million at

December 31, 2002 is expected to be recognized in earnings over the next three years.

Stock Compensation

Hughes issues GM Class H common stock options to employees with grant prices equal to the fair

value of the underlying security at the date of grant. No compensation cost has been recognized for

options in accordance with the provisions of Accounting Principles Board (“APB”) Opinion No. 25,

“Accounting for Stock Issued to Employees” in the consolidated statements of operations.

Had Hughes followed the fair value based method of accounting for stock-based compensation

under SFAS No. 123, “Accounting for Stock-Based Compensation,” for the years ended December 31,

2002, 2001 and 2000, pro forma earnings (loss) used for computation of available separate

consolidated net income (loss) would have been $(1,112.4) million, $(946.5) million and $585.3 million,

respectively. See Note 13 for additional information regarding the pro forma effect on earnings of

recognizing compensation cost based on the estimated fair value of the stock options granted, as

required by SFAS No. 123.

As discussed more completely below in Note 3, Hughes will adopt the fair value based method of

accounting for stock-based compensation of SFAS No. 123 for all stock-based compensation granted

after December 31, 2002. As a result, Hughes will expense the fair market value of stock-based

compensation newly granted to employees pursuant to SFAS No. 123.

Advertising and Research and Development Costs

Advertising and research and development costs are expensed as incurred. Advertising expenses

were $170.5 million in 2002, $163.0 million in 2001 and $129.6 million in 2000. Expenditures for

research and development were $71.7 million in 2002, $85.8 million in 2001 and $104.5 million in

2000.

Market Concentrations and Credit Risk

Hughes provides services and extends credit to a number of wireless communications equipment

customers and to a large number of consumers, both in the United States and Latin America.

DIRECTV has significant accounts receivable from the National Rural Telecommunications

Cooperative (“NRTC”) and one of the NRTC’s largest affiliates, Pegasus Satellite Television, Inc.

77