DIRECTV 2002 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

broadcasting service, greater than anticipated commission payments for subscriber migration and

favorable settlements of various contracts and claims.

In the fourth quarter of 2000, Sky Perfect completed an initial public offering, at which date the fair

value of Hughes’ interest (diluted by the public offering to approximately 5.3%) in Sky Perfect was

approximately $343 million. In the third quarter of 2001 and fourth quarter of 2000, a portion of the

decline in the value of the Sky Perfect investment was determined to be “other-than-temporary,”

resulting in a write-down of the carrying value of the investment by $212 million and $86 million,

respectively. At December 31, 2001, the investment’s market value approximated its carrying value. In

October 2002, Hughes sold all of its interest in Sky Perfect for approximately $105 million in cash,

resulting in a pre-tax loss of about $24.5 million.

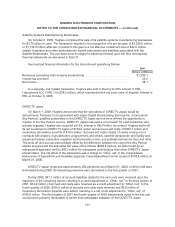

Note 19: Derivative Financial Instruments and Risk Management

Hughes’ cash flows and earnings are subject to fluctuations resulting from changes in foreign

currency exchange rates, interest rates and changes in the market value of its equity investments.

Hughes manages its exposure to these market risks through internally established policies and

procedures and, when deemed appropriate, through the use of derivative financial instruments.

Hughes enters into derivative instruments only to the extent considered necessary to meet its risk

management objectives, and does not enter into derivative contracts for speculative purposes.

Hughes generally conducts its business in U.S. dollars with some business conducted in a variety

of foreign currencies and therefore is exposed to fluctuations in foreign currency exchange rates.

Hughes’ objective in managing its exposure to foreign currency changes is to reduce earnings and

cash flow volatility associated with foreign exchange rate fluctuations. Accordingly, Hughes enters into

foreign exchange contracts to mitigate risks associated with foreign currency denominated assets,

liabilities, commitments and anticipated foreign currency transactions. By policy, Hughes maintains

coverage between minimum and maximum percentages of its anticipated foreign exchange exposures.

The gains and losses on derivative foreign exchange contracts offset changes in value of the related

exposures.

Hughes is exposed to interest rate changes from its outstanding fixed rate and floating rate

borrowings. Hughes manages its fixed to floating rate debt mix to mitigate the impact of adverse

changes in interest rates on earnings and cash flows and on the market value of its borrowings. In

accordance with policy, from time to time Hughes may enter into interest rate hedging contracts which

effectively convert floating rate borrowings to fixed, or fixed rate borrowings to floating.

Hughes is exposed to credit risk in the event of non-performance by the counterparties to its

derivative financial instrument contracts. While Hughes believes this risk is remote, credit risk is

managed through the periodic monitoring and approval of financially sound counterparties.

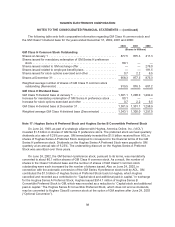

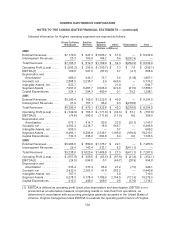

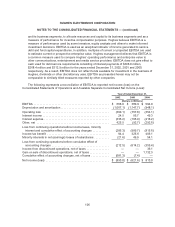

Note 20: Segment Reporting

Hughes’ segments, which are differentiated by their products and services, include Direct-To-

Home Broadcast, Satellite Services, and Network Systems. Direct-To-Home Broadcast is engaged in

acquiring, promoting, selling and/or distributing digital entertainment programming via satellite to

residential and commercial customers and provided land-based DSL services. Satellite Services is

102