DIRECTV 2002 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

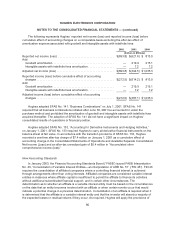

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

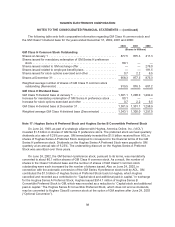

has $24.2 million of foreign tax credits which will expire in 2006, $37.2 million of foreign tax credits

which will expire in 2007 and $58.6 million of foreign tax credits which will expire in 2008. A valuation

allowance was provided for $58.5 million of foreign tax credits. At December 31, 2002, Hughes has

$46.3 million of alternative minimum tax credits, which can be carried forward indefinitely and

$14.0 million of general business credits which will expire between 2021 and 2022. At December 31,

2002, Hughes’ subsidiaries have $98.3 million of deferred tax assets relating to federal net operating

loss carryforwards, which will expire in varying amounts between 2009 and 2021.

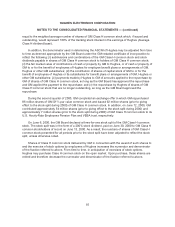

Hughes has an agreement with Raytheon Company (“Raytheon”) which governs Hughes’ rights

and obligations with respect to U.S. federal and state income taxes for all periods prior to the spin-off

and merger of Hughes’ defense electronics business with Raytheon in 1997. Hughes is responsible for

any income taxes pertaining to those periods prior to the merger, including any additional income taxes

resulting from U.S. federal and state tax audits, and is entitled to any U.S. federal and state income tax

refunds relating to those years.

Hughes also has an agreement with Boeing, which governs Hughes’ rights and obligations with

respect to U.S. federal and state income taxes for all periods prior to the sale of Hughes’ Satellite

Businesses. Hughes is responsible for any income taxes pertaining to those periods prior to the sale,

including any additional income taxes resulting from U.S. federal and state tax audits, and is entitled to

any U.S. federal and state income tax refunds relating to those years.

The U.S. federal income tax returns of Hughes have been examined and Hughes has concluded

its administrative appeals process with the Internal Revenue Service (“IRS”) for all tax years through

1994. The IRS is currently examining Hughes’ U.S. federal tax returns for years 1995 through 2000.

Management believes that adequate provision has been made for any adjustment which might be

assessed for open years.

Total taxes receivable from GM at December 31, 2002 and 2001 were approximately $205 million

and $300 million, respectively, of which $75 million and $180 million, respectively, were included in

“Prepaid expenses and other” and $130 million and $120 million, respectively, were included in

“Investments and Other Assets” in the Consolidated Balance Sheets.

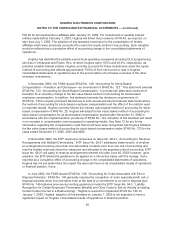

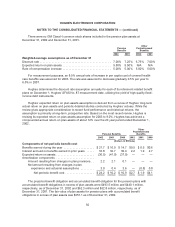

Note 11: Retirement Programs and Other Postretirement Benefits

Substantially all of Hughes’ employees participate in Hughes’ contributory and non-contributory

defined benefit retirement plans. Benefits are based on years of service and compensation earned

during a specified period of time before retirement. Additionally, an unfunded, nonqualified pension

plan covers certain employees. Hughes also maintains a program for eligible retirees to participate in

health care and life insurance benefits generally until they reach age 65. Qualified employees who

elected to participate in the Hughes contributory defined benefit pension plans may become eligible for

these health care and life insurance benefits if they retire from Hughes between the ages of 55 and 65.

90