DIRECTV 2002 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

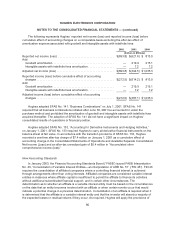

Future minimum lease payments due from customers, included in the above table, related to

satellites to be launched totaled approximately $0.8 billion. Included in the amounts above are

$151.6 million of future lease payments, which may be terminated by the customers pursuant to certain

contractual termination rights.

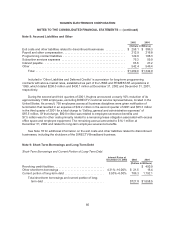

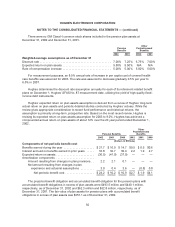

The components of the net investment in sales-type leases are as follows:

2002 2001

(Dollars in Millions)

Total minimum lease payments ............................................ $277.6 $380.7

Less unearned interest income and allowance for doubtful accounts .............. 92.8 128.8

Total net investment in sales-type leases .................................... 184.8 251.9

Less current portion ...................................................... 22.9 24.9

Total long-term net investment in sales-type leases ........................ $161.9 $227.0

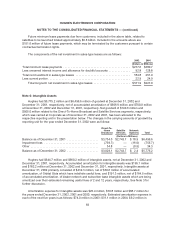

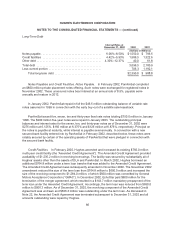

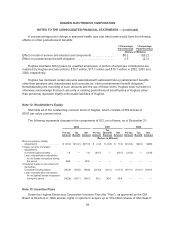

Note 6: Intangible Assets

Hughes had $5,775.2 million and $6,496.6 million of goodwill at December 31, 2002 and

December 31, 2001, respectively, net of accumulated amortization of $606.9 million and $700.0 million

at December 31, 2002 and December 31, 2001, respectively. Net goodwill of $140.6 million and

$505.0 million related to the Direct-To-Home Broadcast and Satellite Services segments, respectively,

which was carried at Corporate as of December 31, 2002 and 2001, has been allocated to the

respective reporting unit in the presentation below. The changes in the carrying amounts of goodwill by

reporting unit for the year ended December 31, 2002 were as follows:

Direct-To-

Home

Broadcast

Satellite

Services

Network

Systems Total

(Dollars in Millions)

Balance as of December 31, 2001 ..................... $3,734.0 $2,743.7 $ 18.9 $6,496.6

Impairmentloss .................................... (739.7) — (16.0) (755.7)

Other ............................................. 34.8 — (0.5) 34.3

Balance as of December 31, 2002 ..................... $3,029.1 $2,743.7 $ 2.4 $5,775.2

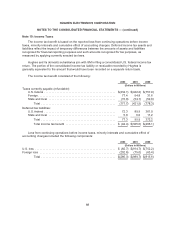

Hughes had $644.7 million and $660.2 million of intangible assets, net at December 31, 2002 and

December 31, 2001, respectively. Accumulated amortization for intangible assets was $195.1 million

and $182.2 million at December 31, 2002 and December 31, 2001, respectively. Intangible assets at

December 31, 2002 primarily consisted of $432.3 million, net of $30.6 million of accumulated

amortization, of Orbital Slots which have indefinite useful lives, and $191.3 million, net of $164.5 million

of accumulated amortization, of dealer network and subscriber base intangible assets which are being

amortized over their estimated remaining useful lives of 2 and 12 years, respectively. See Note 3 for

further discussion.

Amortization expense for intangible assets was $25.4 million, $70.8 million and $68.7 million for

the years ended December 31, 2002, 2001 and 2000, respectively. Estimated amortization expense in

each of the next five years is as follows: $74.0 million in 2003; $31.1 million in 2004; $9.2 million in

83