DIRECTV 2002 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

Hughes enters into derivative instruments only to the extent considered necessary to meet its risk

management objectives, and does not enter into derivative contracts for speculative purposes.

Foreign Currency Risk

Hughes generally conducts its business in U.S. dollars with some business conducted in a variety

of foreign currencies and therefore is exposed to fluctuations in foreign currency exchange rates.

Hughes’ objective in managing its exposure to foreign currency changes is to reduce earnings and

cash flow volatility associated with foreign exchange rate fluctuations. Accordingly, Hughes enters into

foreign exchange contracts to mitigate risks associated with foreign currency denominated assets,

liabilities, commitments and anticipated foreign currency transactions. By policy, Hughes maintains

coverage between minimum and maximum percentages of its anticipated foreign exchange exposures.

The gains and losses on derivative foreign exchange contracts offset changes in value of the related

exposures. The impact of a hypothetical 10% adverse change in exchange rates on the fair values of

foreign exchange contracts and foreign currency denominated assets and liabilities would be a charge

of $12.5 million and $11.6 million, net of taxes, at December 31, 2002 and December 31, 2001,

respectively.

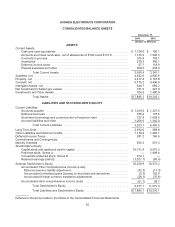

Investments

Hughes maintains investments in publicly-traded common stock of unaffiliated companies and is

therefore subject to equity price risk. These investments are classified as available-for-sale and,

consequently, are reflected in Hughes’ Consolidated Balance Sheets at fair value with unrealized gains

or losses, net of taxes, recorded as part of OCI, a separate component of stockholder’s equity.

Declines in market value that are judged to be “other-than-temporary” are charged to “Other, net” in the

Consolidated Statements of Operations and Available Separate Consolidated Net Income (Loss). The

fair values of the investments in such common stock were $98.2 million and $725.4 million at

December 31, 2002 and December 31, 2001, respectively, based on closing market prices. A 10%

decline in the market price of these investments would cause the fair value of the investments in

common stock to decrease by $9.8 million and $72.5 million at December 31, 2002 and December 31,

2001, respectively. No actions have been taken by Hughes to hedge this market risk exposure.

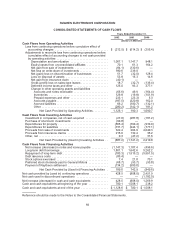

Interest Rate Risk

Hughes is subject to interest rate risk related to its outstanding debt of $3.1 billion at

December 31, 2002 and $2.6 billion at December 31, 2001. As of December 31, 2002, debt consisted

of PanAmSat’s fixed rate borrowings of $1,550.0 million and variable rate borrowings of $1,000 million,

Hughes’ variable rate borrowings of $506.3 million, and various other floating and fixed rate

borrowings. Hughes is subject to fluctuating interest rates, which may adversely impact its consolidated

results of operations and cash flows for its variable rate bank borrowings. At December 31, 2002,

outstanding borrowings bore interest rates ranging from 4.3% to 16.0%. As of December 31, 2002, the

hypothetical impact of a one percentage point increase in interest rates related to Hughes’ outstanding

variable rate debt would be to increase annual interest expense by approximately $15 million.

Credit Risk

Hughes is exposed to credit risk in the event of non-performance by the counterparties to its

derivative financial instrument contracts. While Hughes believes this risk is remote, credit risk is

managed through the periodic monitoring and approval of financially sound counterparties.

***

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The information required by this section is included in Item 7, and is incorporated herein by

reference.

62