DIRECTV 2002 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

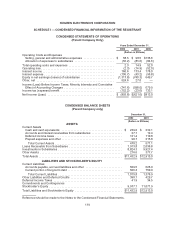

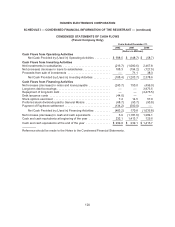

SCHEDULE I — CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT — (concluded)

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

NOTE 1: Basis of Presentation

As discussed in Note 9 of the Notes to the Consolidated Financial Statements, the terms of the

PanAmSat debt and credit facilities restrict PanAmSat from transferring funds to Hughes Electronics

Corporation (“Hughes”) in the form of cash dividends, loans or advances. In the parent company only

financial statements, Hughes’ investment in subsidiaries is stated at cost, net of equity in earnings

(losses) of subsidiaries, since the date of formation/acquisition. Thus, Hughes’ interest in the net

assets of PanAmSat, which totals about $3.0 billion as of December 31, 2002, is included in

“Investments in Subsidiaries” in the accompanying Condensed Balance Sheets of the parent company.

The parent company only financial statements should be read in conjunction with Hughes’ consolidated

financial statements.

On June 11, 2002, Hughes contributed to its wholly-owned subsidiary, DIRECTV Holdings LLC

(“DIRECTV”), certain programming contracts that it acquired from United States Satellite Broadcasting

Company, Inc. in May 1999. On January 1, 2002, Hughes contributed the net assets of its Hughes

Network Systems division to its wholly-owned subsidiary, Hughes Network Systems, Inc. (“HNS”).

These transactions were accounted for as the transfer of net assets by entities under common control.

Accordingly, the parent company financial statements have been prepared as if the transferred net

assets had been contributed to DIRECTV and HNS, respectively, prior to the earliest period presented.

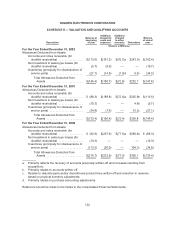

NOTE 2: Loans Receivable from Subsidiaries

Loans receivable from subsidiaries include $1,913.8 million and $315.5 million receivable from

DIRECTV Latin America, LLC (“DLA”) at December 31, 2002 and 2001, respectively, and $1,721.3

million receivable from PanAmSat at December 31, 2001. The loans receivable from DLA bear interest

at rates ranging from 4.25% to 12.61%. The loan receivable from PanAmSat was repaid in full in

February 2002.

NOTE 3: Credit Facilities

See Note 9 of the Notes to the Consolidated Financial Statements.

NOTE 4: Contingencies

See Note 21 of the Notes to the Consolidated Financial Statements.

NOTE 5: Preferred Stocks

See Note 17 of the Notes to the Consolidated Financial Statements.

121