DIRECTV 2002 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

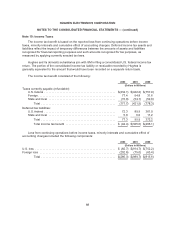

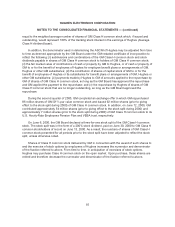

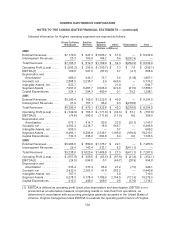

The following table sets forth comparative information regarding GM Class H common stock and

the GM Class H dividend base for the years ended December 31, 2002, 2001 and 2000:

2002 2001 2000

(Shares in Millions)

GM Class H Common Stock Outstanding

Shares at January 1 ............................................ 877.5 875.3 411.3

Shares issued for mandatory redemption of GM Series H preference

stock....................................................... 80.1 — —

Shares issued related to GM exchange offer ........................ — — 276.0

Shares issued related to employee benefit plans ..................... — — 181.5

Shares issued for stock options exercised and other .................. 0.7 2.2 6.5

Shares at December 31 ......................................... 958.3 877.5 875.3

Weighted average number of shares of GM Class H common stock

outstanding (Numerator) ....................................... 919.5 876.3 681.2

GM Class H Dividend Base

GM Class H dividend base at January 1 ............................ 1,301.1 1,298.9 1,292.4

Increase for mandatory redemption of GM Series H preference stock .... 80.1 — —

Increase for stock options exercised and other ...................... 0.7 2.2 6.5

GM Class H dividend base at December 31 ......................... 1,381.9 1,301.1 1,298.9

Weighted average GM Class H dividend base (Denominator) .......... 1,343.1 1,300.0 1,297.0

Note 17: Hughes Series A Preferred Stock and Hughes Series B Convertible Preferred Stock

On June 24, 1999, as part of a strategic alliance with Hughes, America Online, Inc. (“AOL”)

invested $1.5 billion in shares of GM Series H preference stock. The preferred stock accrued quarterly

dividends at a rate of 6.25% per year. GM immediately invested the $1.5 billion received from AOL in

shares of Hughes Series A Preferred Stock designed to correspond to the financial terms of the GM

Series H preference stock. Dividends on the Hughes Series A Preferred Stock were payable to GM

quarterly at an annual rate of 6.25%. The underwriting discount on the Hughes Series A Preferred

Stock was amortized over three years.

On June 24, 2002, the GM Series H preference stock, pursuant to its terms, was mandatorily

converted to about 80.1 million shares of GM Class H common stock. As a result, the number of

shares in the Class H dividend base and the number of shares of GM Class H common stock

outstanding were each increased by the number of shares issued. Also on June 24, 2002, in

connection with the automatic conversion of the GM Series H preference stock held by AOL, GM

contributed the $1.5 billion of Hughes Series A Preferred Stock back to Hughes, which Hughes

cancelled and recorded as a contribution to “Capital stock and additional paid-in capital.” In exchange

for the Hughes Series A Preferred Stock, Hughes issued $914.1 million of Hughes Series B

Convertible Preferred Stock to GM, which was recorded as a reduction to “Capital stock and additional

paid-in capital.” The Hughes Series B Convertible Preferred Stock, which does not accrue dividends,

may be converted to Hughes Class B common stock at the option of GM anytime after June 24, 2003

(“Optional Conversion”).

98