DIRECTV 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

In April 2002, the FASB issued SFAS No. 145, “Rescission of FASB Statements No. 4, 44 and 64,

Amendment of FASB Statement No. 13 and Technical Corrections.” SFAS No. 145 eliminates the

requirement to present gains and losses on the early extinguishment of debt as an extraordinary item,

and resolves accounting inconsistencies for certain lease modifications. Hughes’ adoption of this

standard on January 1, 2003 is not expected to have an impact on Hughes’ consolidated results of

operations or financial position.

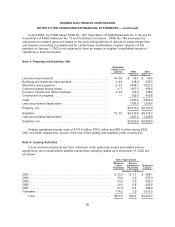

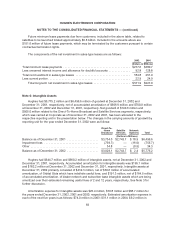

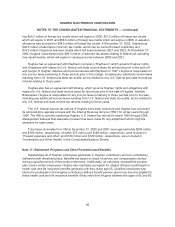

Note 4: Property and Satellites, Net

Estimated

Useful Lives

(years) 2002 2001

(Dollars in Millions)

Land and improvements .................................... 10–30 $ 55.1 $ 54.4

Buildings and leasehold improvements ........................ 2–40 338.5 323.9

Machinery and equipment ................................... 2–23 1,968.1 1,627.2

Customer leased set-top boxes .............................. 4–7 867.5 969.5

Furniture, fixtures and office machines ........................ 2–15 154.9 128.6

Constructioninprogress .................................... — 399.3 450.8

Total .................................................... 3,783.4 3,554.4

Less accumulated depreciation .............................. 1,766.0 1,356.6

Property,net.............................................. $2,017.4 $2,197.8

Satellites ................................................. 12–16 $6,419.8 $6,215.4

Less accumulated depreciation .............................. 1,497.2 1,408.8

Satellites, net ............................................. $4,922.6 $4,806.6

Hughes capitalized interest costs of $116.8 million, $76.3 million and $82.4 million during 2002,

2001 and 2000, respectively, as part of the cost of its property and satellites under construction.

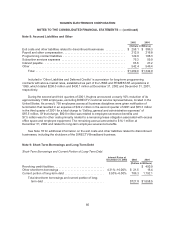

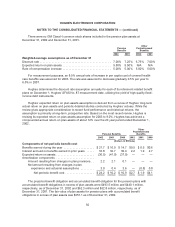

Note 5: Leasing Activities

Future minimum payments due from customers under sales-type leases and related service

agreements, and noncancelable satellite transponder operating leases as of December 31, 2002 are

as follows:

Sales-Type Leases

Minimum

Lease

Payments

Service

Agreement

Payments

Operating

Leases

(Dollars in Millions)

2003 ..................................................... $ 39.3 $ 3.1 $ 568.1

2004 ..................................................... 39.2 3.0 526.3

2005 ..................................................... 39.2 3.0 502.3

2006 ..................................................... 24.5 0.8 502.6

2007 ..................................................... 21.2 0.4 408.9

Thereafter ................................................. 114.2 1.9 1,915.5

Total.................................................. $277.6 $12.2 $4,423.7

82