DIRECTV 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

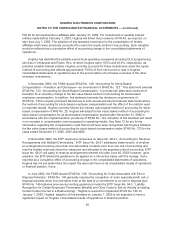

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

identifiable intangible assets of acquired businesses, and intangible assets with indefinite lives were

amortized using the straight-line method over periods not exceeding 40 years. Other intangible assets

are amortized using the straight-line method over their expected useful lives, which range from 5 to

15 years.

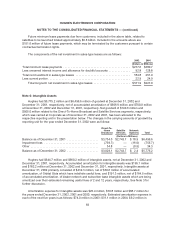

Broadcast Programming Rights

The cost of television programming broadcast rights is recognized when the related programming

is distributed. The cost of television programming rights to distribute live sporting events is charged to

expense using the straight-line method as the events occur over the course of the season or

tournament. These costs are included in “Broadcast programming and other costs” in the consolidated

statements of operations.

Advance payments in the form of cash and equity instruments from programming content

providers for carriage of their signal are deferred and recognized as a reduction of programming costs

on a straight-line basis over the related contract term. Equity instruments are recorded at fair value

based on quoted market prices or appraised values, based on an independent third-party valuation.

Also recorded as a reduction of programming costs is the amortization of a provision for above-market

programming contracts that was recorded in connection with the United States Satellite Broadcasting

Company, Inc. (“USSB”) transaction in May 1999. The provision was based upon an independent third-

party appraisal and recorded at its net present value, with interest expense recognized over the

remaining term of the contract. The current and long-term portions of these deferred credits are

recorded in the Consolidated Balance Sheets in “Accrued liabilities and other” and “Other Liabilities

and Deferred Credits” and are being amortized using the interest method over the related contract

terms of 92 months.

Software Development Costs

Other assets include certain software development costs capitalized in accordance with SFAS

No. 86, “Accounting for the Costs of Computer Software to be Sold, Leased, or Otherwise Marketed.”

Capitalized software development costs at December 31, 2002 and 2001, net of accumulated

amortization of $170.2 million and $147.8 million, respectively, totaled $88.0 million and $85.1 million,

respectively. The software is amortized using the greater of the units of revenue method or the straight-

line method over its estimated useful life, not in excess of five years. Software program reviews are

conducted to ensure that capitalized software development costs are properly treated and costs

associated with programs that are not generating revenues are expensed.

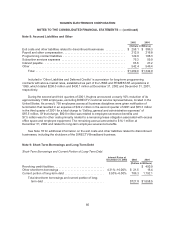

Valuation of Long-Lived Assets

Hughes evaluates the carrying value of long-lived assets to be held and used, other than goodwill

and intangible assets with indefinite lives, when events and circumstances warrant such a review. The

carrying value of a long-lived asset is considered impaired when the anticipated undiscounted cash

flow from such asset is separately identifiable and is less than its carrying value. In that event, a loss is

recognized based on the amount by which the carrying value exceeds the fair value of the long-lived

asset. Fair value is determined primarily using the estimated cash flows associated with the asset

under review, discounted at a rate commensurate with the risk involved. Losses on long-lived assets to

75