DIRECTV 2002 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

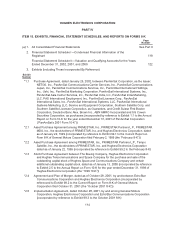

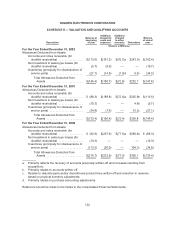

HUGHES ELECTRONICS CORPORATION

SUPPLEMENTAL INFORMATION

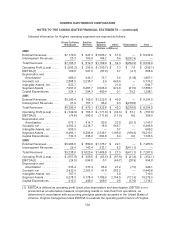

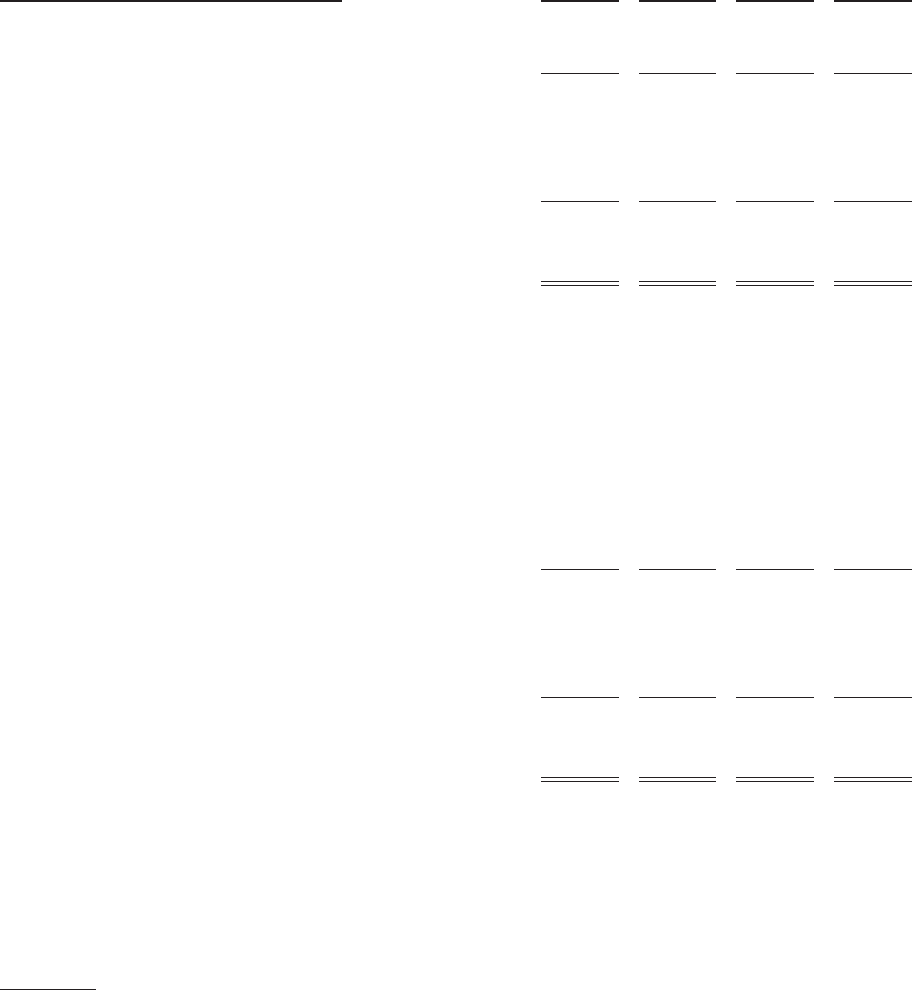

Selected Quarterly Data (Unaudited) 1st 2nd 3rd 4th

(Dollars in Millions Except Per Share Amounts)

2002 Quarters

Revenues ........................................ $2,038.4 $2,210.0 $2,214.8 $2,471.7

Income (loss) before income taxes, minority interests and

cumulative effect of accounting change(1) ............ $ (241.5) $ (244.5) $ (15.3) $ 216.0

Income tax benefit (expense) ........................ 91.8 92.9 5.8 (96.1)

Minority interests in net earnings of subsidiaries ......... (6.7) (3.5) (4.1) (7.3)

Cumulative effect of accounting change, net of taxes ..... (681.3) — — —

Net income (loss) .................................. (837.7) (155.1) (13.6) 112.6

Earnings (loss) used for computation of available separate

consolidated net income (loss) ..................... $ (861.8) $ (177.9) $ (13.6) $ 112.6

Average number of shares of General Motors Class H

common stock outstanding (in millions) (Numerator) .... 877.6 884.0 958.1 958.2

Average Class H dividend base (in millions) (Denominator) 1,301.2 1,307.6 1,381.7 1,381.8

Available separate consolidated net income (loss) ....... $ (581.2) $ (120.3) $ (9.4) $ 78.1

Stock price range of General Motors Class H common

stock

High ......................................... $ 17.55 $ 17.00 $ 11.25 $ 12.00

Low ......................................... $ 12.50 $ 8.49 $ 8.35 $ 8.00

2001 Quarters

Revenues ........................................ $1,893.2 $1,985.4 $2,103.8 $2,281.6

Loss before income taxes, minority interests and

cumulative effect of accounting change .............. $ (172.1) $ (257.7) $ (321.2) $ (238.7)

Income tax benefit ................................. 49.9 74.8 93.1 107.8

Minority interests in net (earnings) losses of subsidiaries . . 24.3 26.4 0.9 (1.7)

Cumulative effect of accounting change, net of taxes ..... (7.4) — — —

Netloss .......................................... (105.3) (156.5) (227.2) (132.6)

Loss used for computation of available separate

consolidated net income (loss) ..................... $ (128.6) $ (179.8) $ (250.4) $ (155.9)

Average number of shares of General Motors Class H

common stock outstanding (in millions) (Numerator) .... 875.4 875.9 876.8 877.3

Average Class H dividend base (in millions) (Denominator) 1,299.1 1,299.6 1,300.5 1,300.9

Available separate consolidated net income (loss) ....... $ (86.7) $ (121.2) $ (168.8) $ (105.1)

Stock price range of General Motors Class H common

stock

High ......................................... $ 28.00 $ 25.09 $ 21.65 $ 15.80

Low ......................................... $ 17.90 $ 17.50 $ 11.50 $ 12.12

(1) Included as part of Income (loss) before income taxes, minority interests and cumulative effect of

accounting change for the fourth quarter of 2002 is a $600 million gain for the settlement on the

terminated merger agreement with EchoStar, partially offset by a $146.3 million write down for

other-than-temporary declines in the fair value of certain equity securities and a $92.8 million

charge related to the shutdown of the DIRECTV Broadband business.

112