DIRECTV 2002 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

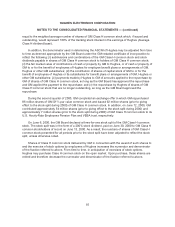

There were no GM Class H common stock shares included in the pension plan assets at

December 31, 2002 and December 31, 2001.

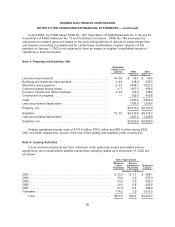

Pension

Benefits

Other

Postretirement

Benefits

2002 2001 2002 2001

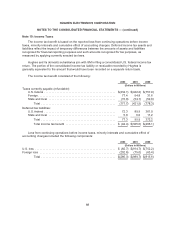

Weighted-average assumptions as of December 31

Discount rate ............................................... 7.00% 7.25% 6.75% 7.00%

Expected return on plan assets ................................ 9.50% 9.50% N/A N/A

Rate of compensation increase ................................ 5.00% 5.00% 5.00% 5.00%

For measurement purposes, an 8.0% annual rate of increase in per capita cost of covered health

care benefits was assumed for 2003. The rate was assumed to decrease gradually 0.5% per year to

6.0% in 2007.

Hughes determines the discount rate assumption annually for each of its retirement-related benefit

plans on December 1, Hughes’ SFAS No. 87 measurement date, utilizing the yield of high quality fixed-

income debt instruments.

Hughes’ expected return on plan assets assumption is derived from a review of Hughes’ long-term

actual return on plan assets and periodic detailed studies conducted by Hughes’ actuary. While the

review gives appropriate consideration to recent fund performance and historical returns, the

assumption is primarily a long-term, prospective rate. Based on the most recent review, Hughes is

revising its expected return on plan assets assumption for 2003 to 9.0%. Hughes has achieved a

compounded annual return on plan assets of about 12% over the 20 year period ended December 1,

2002.

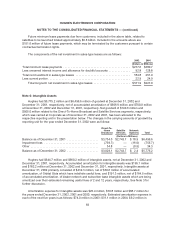

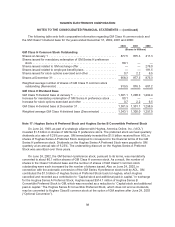

Pension Benefits

Other

Postretirement

Benefits

2002 2001 2000 2002 2001 2000

(Dollars in Millions)

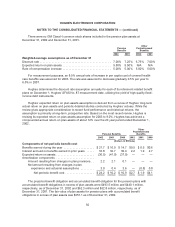

Components of net periodic benefit cost

Benefits earned during the year .................... $21.7 $16.0 $14.7 $0.5 $0.5 $0.6

Interest accrued on benefits earned in prior years ..... 33.8 32.7 30.4 2.2 1.9 2.7

Expected return on assets ......................... (36.5) (41.0) (37.9) — — —

Amortization components .........................

Amount resulting from changes in plan provisions . . 2.2 2.1 0.1 — — —

Net amount resulting from changes in plan

experience and actuarial assumptions ......... 3.0 0.4 3.6 — (0.5) 0.8

Net periodic benefit cost ................... $24.2 $10.2 $10.9 $2.7 $1.9 $4.1

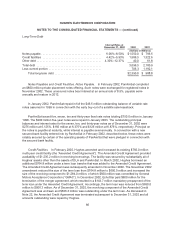

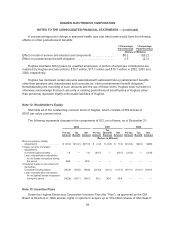

The projected benefit obligation and accumulated benefit obligation for the pension plans with

accumulated benefit obligations in excess of plan assets were $493.5 million and $440.1 million,

respectively, as of December 31, 2002 and $62.3 million and $52.8 million, respectively, as of

December 31, 2001. The fair value of plan assets for pension plans with accumulated benefit

obligations in excess of plan assets was $357.1 as of December 31, 2002.

92