DIRECTV 2002 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

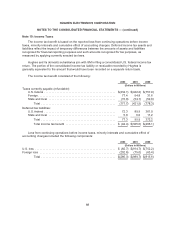

equal to the weighted-average number of shares of GM Class H common stock which, if issued and

outstanding, would represent 100% of the tracking stock interest in the earnings of Hughes (Average

Class H dividend base).

In addition, the denominator used in determining the ASCNI of Hughes may be adjusted from time

to time as deemed appropriate by the GM Board under the GM restated certificate of incorporation to

reflect the following: (i) subdivisions and combinations of the GM Class H common stock and stock

dividends payable in shares of GM Class H common stock to holders of GM Class H common stock;

(ii) the fair market value of contributions of cash or property by GM to Hughes, or of cash or property of

GM to or for the benefit of employees of Hughes for employee benefit plans or arrangements of GM,

Hughes or other GM subsidiaries; (iii) the contribution of shares of capital stock of GM to or for the

benefit of employees of Hughes or its subsidiaries for benefit plans or arrangements of GM, Hughes or

other GM subsidiaries; (iv) payments made by Hughes to GM of amounts applied to the repurchase by

GM of shares of GM Class H common stock, so long as the GM Board has approved the repurchase

and GM applied the payment to the repurchase; and (v) the repurchase by Hughes of shares of GM

Class H common stock that are no longer outstanding, so long as the GM Board approved the

repurchase.

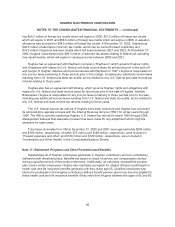

During the second quarter of 2000, GM completed an exchange offer in which GM repurchased

86 million shares of GM $1

2

⁄

3

par value common stock and issued 92 million shares (prior to giving

effect to the stock split during 2000) of GM Class H common stock. In addition, on June 12, 2000, GM

contributed approximately 54 million shares (prior to giving effect to the stock split during 2000) and

approximately 7 million shares (prior to the stock split during 2000) of GM Class H common stock to its

U.S. Hourly-Rate Employees Pension Plan and VEBA trust, respectively.

On June 6, 2000, the GM Board declared a three-for-one stock split of the GM Class H common

stock. The stock split was in the form of a 200% stock dividend, paid on June 30, 2000 to GM Class H

common stockholders of record on June 13, 2000. As a result, the numbers of shares of GM Class H

common stock presented for all periods prior to the stock split have been adjusted to reflect the stock

split, unless otherwise noted.

Shares of Class H common stock delivered by GM in connection with the award of such shares to

and the exercise of stock options by employees of Hughes increases the numerator and denominator

of the fraction referred to above. From time to time, in anticipation of exercises of stock options,

Hughes may purchase Class H common stock on the open market. Upon purchase, these shares are

retired and therefore decrease the numerator and denominator of the fraction referred to above.

97