DIRECTV 2002 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

2002 equity losses from unconsolidated affiliates are primarily comprised of losses at the DLA

local operating companies. 2001 equity losses from unconsolidated affiliates are primarily comprised of

losses at the DLA LOC’s and Hughes Tele.com (India) Limited (“HTIL”), and in 2000, DIRECTV Japan.

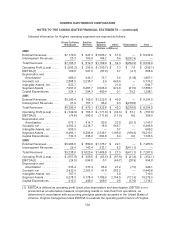

Note 15: Related-Party Transactions

In the ordinary course of its operations, Hughes sells products and services to related parties,

which include GM and equity method investees. During the years ended December 31, 2002, 2001

and 2000, Hughes sold telecommunications services and equipment to GM and HTIL, and sold

broadcast programming and other services to DLA LOC’s located in Puerto Rico, Venezuela and

Argentina. As a result of the HTIL and Galaxy Entertainment Argentina S.A. (“GEA”) transactions

described in Note 18, HTIL and GEA are not considered related parties subsequent to the completion

of those transactions on December 6, 2002 and May 1, 2001, respectively.

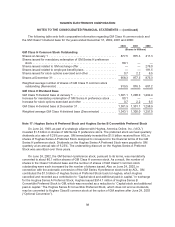

The following table summarizes significant related-party transactions for the years ended

December 31:

2002 2001 2000

(Dollars in Millions)

Revenues ............................................... $211.1 $238.8 $243.3

Costs and expenses ...................................... 117.9 126.2 149.9

The following table sets forth the amounts of accounts receivable from related parties as of

December 31:

2002 2001

(Dollars in Millions)

Accounts receivable from related parties ............................ $317.4 $237.7

Long-term accounts receivable from related parties ................... — 75.8

The December 31, 2002 accounts receivable balance is primarily from DLA LOC’s.

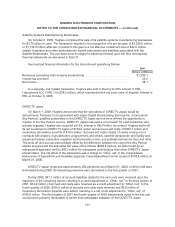

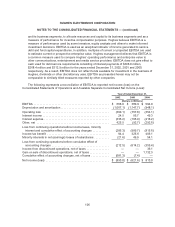

Note 16: Available Separate Consolidated Net Income (Loss)

GM Class H common stock is a “tracking stock” of GM designed to provide holders with financial

returns based on the financial performance of Hughes. Holders of GM Class H common stock have no

direct rights in the equity or assets of Hughes, but rather have rights in the equity and assets of GM

(which includes 100% of the stock of Hughes).

Amounts available for the payment of dividends on GM Class H common stock are based on the

Available Separate Consolidated Net Income (Loss) (“ASCNI”) of Hughes. The ASCNI of Hughes is

determined quarterly and is equal to the net income (loss) of Hughes, excluding the effects of the GM

purchase accounting adjustment arising from GM’s acquisition of Hughes and reduced by the effects of

preferred stock dividends paid and/or payable to GM (earnings (loss) used for computation of ASCNI),

multiplied by a fraction, the numerator of which is equal to the weighted-average number of shares of

GM Class H common stock outstanding during the period and the denominator of which is a number

96