DIRECTV 2002 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

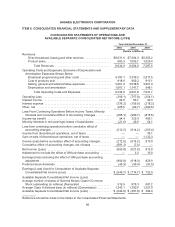

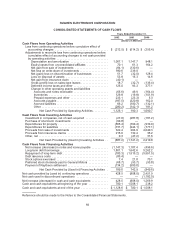

Net cash provided by operating activities includes cash payments made for interest of

$398.0 million, $268.4 million and $312.9 million in 2002, 2001 and 2000, respectively and net cash

refunds received for prior year income taxes of $354.5 million, $310.7 million and $290.5 million in

2002, 2001 and 2000, respectively.

Contracts in Process

Contracts in process are stated at costs incurred plus estimated profit, less amounts billed to

customers and advances and progress payments applied. Engineering, tooling, manufacturing, and

applicable overhead costs, including administrative, research and development and selling expenses,

are charged to costs and expenses when incurred. Advances offset against contract related

receivables amounted to $38.2 million and $37.6 million at December 31, 2002 and 2001, respectively.

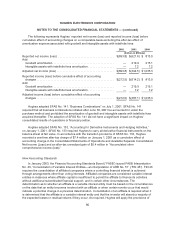

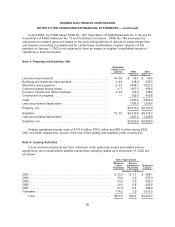

Inventories

Inventories are stated at the lower of cost or market principally using the average cost method.

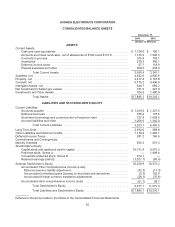

Major Classes of Inventories 2002 2001

(Dollars in Millions)

Productive material and supplies ................................... $ 34.7 $ 58.3

Work in process ................................................. 111.2 145.7

Finished goods .................................................. 118.9 183.2

Provision for excess or obsolete inventory ............................ (34.5) (27.1)

Total....................................................... $230.3 $360.1

Property, Satellites and Depreciation

Property and satellites are carried at cost. Satellite costs include construction costs, launch costs,

launch insurance, incentive obligations, direct development costs and capitalized interest. Capitalized

satellite costs represent satellites under construction and the costs of successful satellite launches.

The proportionate cost of a satellite, net of accumulated depreciation and insurance proceeds, is

written-off in the period a full or partial loss of the satellite occurs. Capitalized customer leased set-top

box costs include the cost of hardware and installation. Depreciation is computed generally using the

straight-line method over the estimated useful lives of the assets. Leasehold improvements are

amortized over the lesser of the life of the asset or term of the lease.

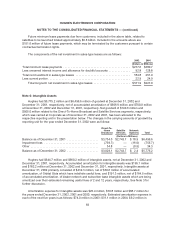

Intangible Assets

As discussed below in Note 3, with the adoption of SFAS No. 142, “Goodwill and Other Intangible

Assets” on January 1, 2002, Hughes ceased amortization of goodwill and intangible assets with

indefinite lives. Goodwill and intangible assets with indefinite lives are subject to write-down, as

needed, based upon an impairment analysis that must occur at least annually, or sooner if an event

occurs or circumstances change that would more likely than not result in an impairment loss. Prior to

January 1, 2002, goodwill, which represents the excess of the cost over the net tangible and

74