DIRECTV 2002 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

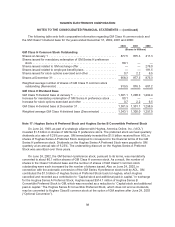

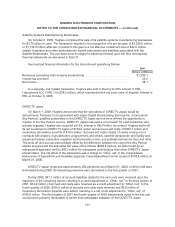

stock with exercise prices ranging from $14.64 per share to $63.25 per share. The options vest ratably

over three to four years and have a remaining life ranging from four to ten years. At December 31,

2002, 2,749,027 options were exercisable at a weighted average exercise price of $36.37 per share.

The PanAmSat options have been considered in the following pro forma analysis.

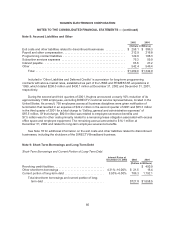

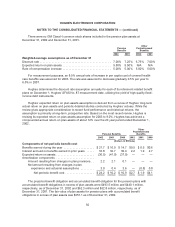

The following table presents pro forma information as if Hughes recorded compensation cost using

the fair value of issued options on their grant date, as required by SFAS No. 123, “Accounting for Stock

Based Compensation”:

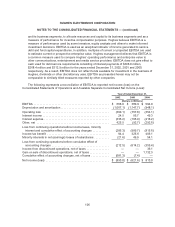

2002 2001 2000

(Dollars in Millions)

Earnings (loss) used for computation of available separate

consolidated net income (loss), as reported ..................... $ (940.7) $(714.7) $ 732.9

Assumed stock compensation costs ............................. (171.7) (231.8) (147.6)

Pro forma earnings (loss) used for computation of available separate

consolidated net income (loss) ................................ $(1,112.4) $(946.5) $ 585.3

The pro forma amounts for compensation cost are not indicative of the effects on operating results

for future periods.

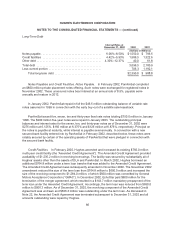

The following table presents the estimated weighted-average fair value for options granted under

the Plan using the Black-Scholes valuation model and the assumptions used in the calculations:

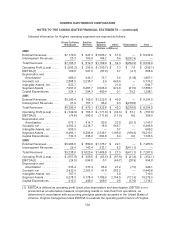

2002 2001 2000

Estimatedfairvalueperoptiongranted .............................. $ 9.19 $13.66 $20.39

Average exercise price per option granted ............................ 15.71 23.34 37.06

Expected stock volatility ........................................... 51.6% 51.3% 42.1%

Risk-free interest rate ............................................. 4.7% 5.1% 6.5%

Expected option life (in years) ...................................... 7.0 7.0 6.9

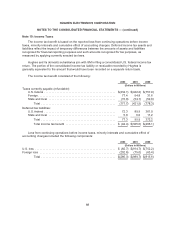

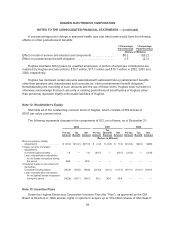

Note 14: Other Income and Expenses

2002 2001 2000

(Dollars in Millions)

Equity losses from unconsolidated affiliates ......................... $ (70.1) $ (61.3) $(164.2)

EchoStar Merger termination payment ............................. 600.0 — —

Net gain (loss) on discontinuation of businesses ..................... 41.1 32.0 (128.4)

Net loss on write-down of investments to fair value ................... (180.6) (239.0) —

Net gain from sale of investments ................................. 84.1 130.6 —

Other ........................................................ (49.0) 45.0 —

TotalOther,net ............................................ $425.5 $ (92.7) $(292.6)

95