DIRECTV 2002 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

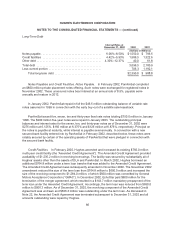

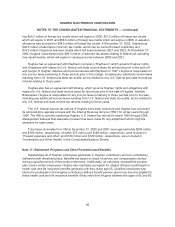

In February 2002, PanAmSat obtained a bank facility in the amount of $1,250 million. The bank

facility is comprised of a $250 million revolving credit facility, which was undrawn as of December 31,

2002, a $300 million Tranche A Term Loan and a $700 million Tranche B Term Loan, both of which

were fully drawn as of December 31, 2002. This bank facility replaced a previously existing $500

million unsecured multi-year revolving credit facility. The new revolving credit facility and the Tranche A

Term Loan bear interest at the London Interbank Offered Rate (“LIBOR”) plus 3.0%. The Tranche B

Term Loan bears interest at LIBOR plus 3.5%. The revolving credit facility and Tranche A Term Loan

interest rates may be increased or decreased based upon changes in PanAmSat’s total leverage ratio,

as defined by the credit agreement. The revolving credit facility and the Tranche A Term Loan

terminate in 2007 and the Tranche B Term Loan matures in 2008. Principal payments under the

Tranche A Term Loan are due in varying amounts from 2004 to 2007. Principal payments under the

Tranche B Term Loan are due primarily at maturity. The facilities are secured ratably by substantially

all of PanAmSat’s operating assets, including its satellites. PanAmSat repaid a $1,725 million

intercompany loan from Hughes in February 2002, using proceeds from the bank facility and notes

payable described above, as well as existing cash balances.

On October 1, 2001, Hughes entered into a $2.0 billion revolving credit facility with GMAC. The

facility was subsequently amended in February and November 2002. The most recent amendment

reduced the size of the facility to $1,500 million and provided for a commitment through August 31,

2003. The facility is comprised of a $1,500 million tranche secured by a $1,500 million Hughes cash

deposit. Borrowings under the facility bear interest at GMAC’s cost of funds plus 0.125%. The

$1,500 million cash deposit earns interest at a rate equivalent to GMAC’s cost of funds. Hughes has

the legal right of setoff with respect to the $1,500 million GMAC cash deposit, and accordingly offsets it

against amounts borrowed from GMAC under the $1,500 million tranche in the consolidated statement

of financial position. The facility was fully drawn as of December 31, 2002.

On January 5, 2001, DLA entered into a $450.0 million revolving credit facility. The obligations

under the DLA facility were assigned to Hughes in February 2002. In addition, the obligations under

SurFin Ltd.’s unsecured revolving credit facilities of $400.0 million and $212.5 million were assigned to

Hughes in February 2002.

Other. $61.5 million in other short-term and long-term debt, related primarily to DLA and Hughes

Network Systems, Inc.’s (“HNS”) international subsidiaries, was outstanding at December 31, 2002,

bearing fixed and floating rates of interest of 4.30% to 16.00%. Principal on these borrowings is due in

varying amounts through 2007.

Covenants and Restrictions. Hughes’ and its subsidiaries’ ability to borrow under the credit

facilities is contingent upon meeting financial and other covenants. The agreements also include

certain operational restrictions. These covenants limit Hughes’ and its subsidiaries’ ability to, among

other things: incur or guarantee additional indebtedness; make restricted payments, including

dividends; create or permit to exist certain liens; enter into business combinations and asset sale

transactions; make investments; enter into transactions with affiliates; and enter into new business.

The terms of the PanAmSat debt and credit facilities restrict PanAmSat from transferring funds to

Hughes in the form of cash dividends, loans or advances. At December 31, 2002, Hughes and its

subsidiaries were in compliance with all such covenants.

87