DIRECTV 2002 Annual Report Download - page 120

Download and view the complete annual report

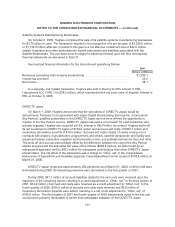

Please find page 120 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

is seeking to restructure include certain long-term or exclusive programming agreements which have

resulted in payment obligations substantially in excess of the current economic value of the

programming to DLA. DLA has ceased making payments under certain of these agreements and has

received notices of default relating to approximately $32 million claimed to be owed to programmers

and a claim that DLA’s restructuring had resulted in an acceleration of an obligation to repurchase a

4% equity interest in DLA for $195 million. DLA does not believe that the purchase obligation has been

accelerated. All such amounts correspond to agreements that are currently under renegotiation. If DLA

does not comply with its obligations under its programming contracts and is unsuccessful in reaching a

settlement with the relevant programmers, such programmers could seek to terminate the

programming contracts, which would result in a loss of such programming to DLA. If the discussions do

not result in a reasonable agreement in the near future, DLA has indicated that it would consider other

options, including restructuring the company under Chapter 11 of the U.S. bankruptcy law. If DLA

initiates proceedings under Chapter 11 of the U.S. bankruptcy law, it could reject some or all of its

long-term programming agreements (as well as other non-essential executory contracts), in which

event the programming related to such rejected agreements would no longer be available to DLA. This

could result in increased churn or reduced demand for the DLA service, which would be a

consideration for DLA in determining which programming contracts to reject in the event of Chapter 11

bankruptcy proceedings. A filing under Chapter 11 of the U.S. bankruptcy law could result in a charge

in a future period that could be material to Hughes’ consolidated results of operations and financial

position.

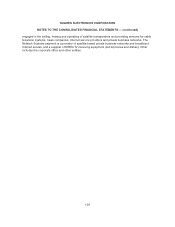

On February 19, 2003, PanAmSat filed proofs of loss under the insurance policies for Galaxy XI

and PAS-1R for constructive total losses based on degradation of the solar panels. Service to existing

customers has not been affected, and PanAmSat expects that both of these satellites will continue to

serve these existing customers. The insurance policies for these satellites total approximately

$289 million and $345 million, respectively, and both include a salvage provision for PanAmSat to

share 10% of future revenues from these satellites with their respective insurers if the proof of loss is

accepted. The availability and use of the proceeds from these insurance claims are restricted by the

agreements governing PanAmSat’s debt obligations. No assurances can be made that the proof of

loss with respect to these two satellites will be accepted by the insurers. PanAmSat is working with the

satellite manufacturer to determine the long-term implications to the satellites and will continue to

assess the operational impact these losses may have. At this time, based upon all information currently

available to PanAmSat, as well as planned modifications to the operation of the satellites in order to

maximize revenue generation, PanAmSat currently expects to operate these satellites through their

expected economic ends of life, although a portion of the transponder capacity on these satellites will

not be useable during such time. Hughes currently believes that the net book values of these satellites

are fully recoverable and does not expect a material impact on 2003 revenues as a result of the

difficulties on these two satellites.

On February 28, 2003, GM announced plans to contribute approximately 150 million shares of GM

Class H common stock to certain of its U.S. employee benefit plans. GM expects to make the

contribution during the month of March 2003. The contribution would increase the amount of GM Class

H common stock held by GM’s employee benefit plans to approximately 330 million shares and reduce

GM’s retained economic interest in Hughes to approximately 20.0% from 30.7%.

As previously reported, Hughes has had periodic discussions with the United States Department

of State (“State Department”) directed at potential settlement of administrative concerns related to past

export activities with China. On December 26, 2002, the State Department issued a formal charging

letter to Hughes and Boeing Satellite Systems, Inc. (“BSS”). As part of the sale of the satellite systems

110