DIRECTV 2002 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

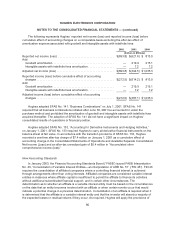

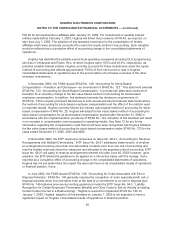

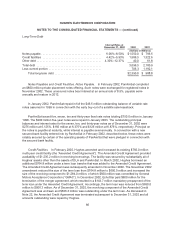

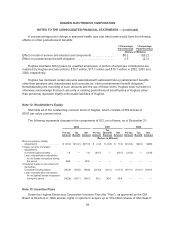

Long-Term Debt

Interest Rates at

December 31, 2002 2002 2001

(Dollars in Millions)

Notes payable ........................................ 6.00%–8.50% $1,550.0 $ 796.5

Credit facilities ....................................... 4.42%–5.93% 1,506.3 1,322.6

Other debt ........................................... 4.30%–12.37% 40.0 61.8

Total debt ........................................... 3,096.3 2,180.9

Less current portion ................................... 706.3 1,192.1

Total long-term debt ............................... $2,390.0 $ 988.8

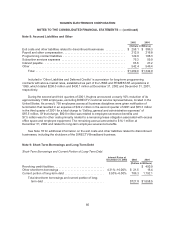

Notes Payables and Credit Facilities. Notes Payable. In February 2002, PanAmSat completed

an $800 million private placement notes offering. Such notes were exchanged for registered notes in

November 2002. These unsecured notes bear interest at an annual rate of 8.5%, payable semi-

annually and mature in 2012.

In January 2002, PanAmSat repaid in full the $46.5 million outstanding balance of variable rate

notes assumed in 1999 in connection with the early buy-out of a satellite sale-leaseback.

PanAmSat issued five, seven, ten and thirty-year fixed rate notes totaling $750.0 million in January

1998. The $200 million five-year notes were repaid in January 2003. The outstanding principal

balances and interest rates for the seven, ten, and thirty-year notes as of December 31, 2002 were

$275 million at 6.125%, $150 million at 6.375% and $125 million at 6.875%, respectively. Principal on

the notes is payable at maturity, while interest is payable semi-annually. In connection with a new

secured bank facility entered into by PanAmSat in February 2002, described below, these notes were

ratably secured by certain of the operating assets of PanAmSat that were pledged in connection with

the secured bank facility.

Credit Facilities. In February 2002, Hughes amended and increased its existing $750.0 million

multi-year credit facility (the “Amended Credit Agreement”). The Amended Credit Agreement provided

availability of $1,235.2 million in revolving borrowings. The facility was secured by substantially all of

Hughes’ assets other than the assets of DLA and PanAmSat. In March 2002, Hughes borrowed an

additional $764.8 million under a term loan tranche that was added to the Amended Credit Agreement.

The Amended Credit Agreement was subsequently amended in November 2002. The November 2002

amendment reduced the size of the term loan from $764.8 million to $650.0 million and increased the

size of the revolving component to $1,284.0 million, of which $500 million was committed by General

Motors Acceptance Corporation (“GMAC”). In December 2002, EchoStar paid $600 million for the

termination of the merger agreement, which resulted in a $143.7 million mandatory prepayment of the

term loan under the Amended Credit Agreement. Accordingly, the term loan was reduced from $650.0

million to $506.3 million. As of December 31, 2002, the revolving component of the Amended Credit

Agreement was undrawn and $506.3 million was outstanding under the term loan. As discussed in

Note 22, the Amended Credit Agreement was terminated subsequent to December 31, 2002 and all

amounts outstanding were repaid by Hughes.

86