DIRECTV 2002 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

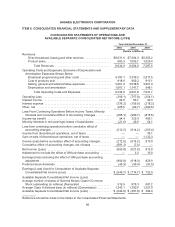

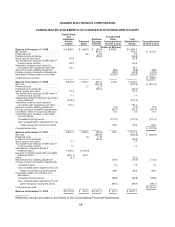

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

Hughes and EchoStar agreed to terminate the merger agreement and certain related agreements.

Under the terms of the termination agreement, EchoStar paid Hughes $600 million in cash and Hughes

retained its 81% ownership position in PanAmSat.

GM has announced that it is currently evaluating a variety of strategic options for Hughes,

including a reduction or elimination of its retained economic interest in Hughes, transactions that would

involve strategic investors and public offerings of GM Class H common stock or related securities for

cash or in exchange for outstanding GM debt obligations. Any such transaction might involve the

separation of Hughes from GM. GM and Hughes have engaged in preliminary discussions with some

parties. No other decisions have been made regarding which options or combinations of options, if any,

GM will pursue. Due to the numerous uncertainties involved in these matters, there can be no

assurance that any transaction or offering will be announced or completed or as to the time at which

such a transaction or offering might be completed.

Note 2: Summary of Significant Accounting Policies

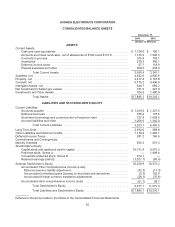

Principles of Consolidation

The accompanying financial statements are presented on a consolidated basis and include the

accounts of Hughes and its domestic and foreign subsidiaries that are more than 50% owned or

controlled by Hughes after elimination of intercompany accounts and transactions. Hughes allocates

earnings and losses to minority interests only to the extent of a minority investor’s investment in a

subsidiary.

Use of Estimates in the Preparation of the Consolidated Financial Statements

The preparation of the consolidated financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make estimates and

assumptions that affect amounts reported therein. Management bases its estimates and assumptions

on historical experience and on various other factors that are believed to be reasonable under the

circumstances. Due to the inherent uncertainty involved in making estimates, actual results reported in

future periods may be affected by changes in those estimates.

Reclassifications

During 2002, Hughes changed the classification of certain subscriber acquisition costs. As a

result, the costs of free programming and the costs of installation and hardware subsidies for

subscribers added through DIRECTV’s direct sales program are now included as part of “Broadcast

programming and other costs” in the Consolidated Statements of Operations and Available Separate

Consolidated Net Income (Loss) rather than in “Selling, general and administrative expenses” where

they had previously been reported. Prior period amounts have been reclassified to conform to the 2002

presentation.

Revenue Recognition

Revenues are generated from sales of direct-to-home broadcast subscriptions, the sale of

transponder capacity and related services through outright sales, sales-type leases and operating

71