DIRECTV 2002 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

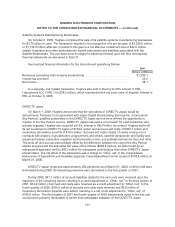

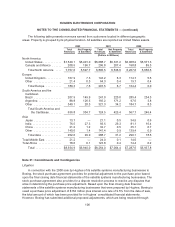

At December 31, 2002, minimum future commitments under noncancelable operating leases

having lease terms in excess of one year were primarily for real property and aggregated

$769.4 million, payable as follows: $252.5 million in 2003, $210.6 million in 2004, $107.6 million in

2005, $52.3 million in 2006, $46.1 million in 2007, and $100.3 million thereafter. Certain of these

leases contain escalation clauses and renewal or purchase options. Rental expenses under operating

leases, net of sublease rental income, were $68.0 million in 2002, $59.7 million in 2001 and

$55.9 million in 2000.

Hughes has minimum commitments under noncancelable satellite construction and launch

contracts and programming agreements. Minimum payments over the terms of applicable contracts are

anticipated to be approximately $3,461.5 million, payable as follows: $825.1 million in 2003,

$596.8 million in 2004, $437.5 million in 2005, $693.0 million in 2006, $762.1 million in 2007, and

$147.0 million thereafter.

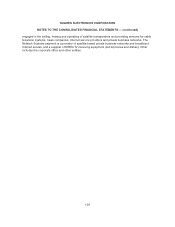

Note 22: Subsequent Events

During the first quarter of 2003, Hughes and AOL agreed to terminate their strategic alliance,

which the companies had entered into in June 1999. In connection with the termination of the alliance,

Hughes recorded a pre-tax charge of $23 million in the fourth quarter of 2002 to “Selling, general and

administrative expenses” and was released from its commitment to spend up to approximately $1

billion in additional sales, marketing, development and promotion efforts in support of certain specified

products and services. Under the terms of the agreement, HNS will continue to provide services to

current bundled AOL broadband subscribers using the HNS high-speed Internet satellite service as the

companies develop a transition plan to an unbundled service.

In the first quarter of 2003, Hughes completed a series of financing transactions to replace the

Amended Credit Agreement with a capital structure that is more long-term in nature. On February 28,

2003, DIRECTV issued $1.4 billion in senior notes due in 2013. The ten-year senior notes are

unsecured indebtedness guaranteed by all of DIRECTV’s domestic subsidiaries and bear interest at

8.375%. In addition, on March 6, 2003, DIRECTV entered into a new senior secured credit facility with

total term loan and revolving loan commitments of $1.675 billion. The new senior secured credit facility

is comprised of a $375.0 million Tranche A Term Loan, $200.0 million of which was undrawn at March

6, 2003, a $1,050.0 million Tranche B Term Loan and a $250.0 million revolving credit facility which

was undrawn at March 6, 2003. The new senior secured credit facility has a term of five to seven years

and is secured by substantially all of DIRECTV’s assets and guaranteed by all of DIRECTV’s domestic

subsidiaries. The revolving credit facility and term loans bear interest at LIBOR plus 3.50%. DIRECTV

distributed to Hughes the net proceeds from the senior secured credit facility and the sale of the senior

notes totaling $2.56 billion. The $200 million undrawn portion of the Tranche A Term Loan is expected

to be drawn by December 31, 2003 with the net proceeds distributed to Hughes. The revolving portion

of the senior secured credit facility will be available to DIRECTV to fund working capital and other

requirements. The above distribution enabled Hughes to repay all amounts outstanding under its

existing Amended Credit Agreement, which was terminated on February 28, 2003, and is expected to

provide sufficient liquidity to fund Hughes’ business plan through projected cash flow breakeven and

for Hughes’ other corporate purposes.

DLA has endured subscriber losses and revenue declines as a result of economic and political

instability affecting various countries in which DLA provides service. As a result, in January 2003, DLA

announced the commencement of discussions with certain programmers, suppliers and business

associates to address DLA’s current financial and operational challenges. The agreements which DLA

109