DIRECTV 2002 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

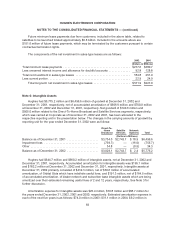

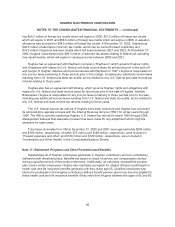

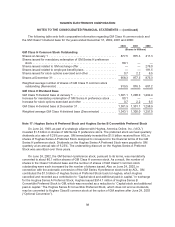

A one-percentage point change in assumed health care cost trend rates would have the following

effects on other postretirement benefits:

1-Percentage

Point Increase

1-Percentage

Point Decrease

(Dollars in Millions)

Effect on total of service and interest cost components ............... $0.2 $(0.2)

Effect on postretirement benefit obligation .......................... 2.5 (2.3)

Hughes maintains 401(k) plans for qualified employees. A portion of employee contributions are

matched by Hughes and amounted to $15.7 million, $17.7 million and $15.1 million in 2002, 2001 and

2000, respectively.

Hughes has disclosed certain amounts associated with estimated future postretirement benefits

other than pensions and characterized such amounts as “other postretirement benefit obligation.”

Notwithstanding the recording of such amounts and the use of these terms, Hughes does not admit or

otherwise acknowledge that such amounts or existing postretirement benefit plans of Hughes (other

than pensions) represent legally enforceable liabilities of Hughes.

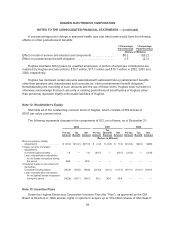

Note 12: Stockholder’s Equity

GM holds all of the outstanding common stock of Hughes, which consists of 200 shares of

$0.01 par value common stock.

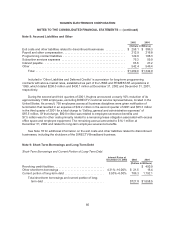

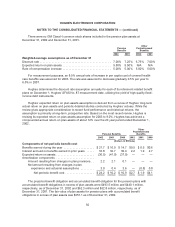

The following represents changes in the components of OCI, net of taxes, as of December 31:

2002 2001 2000

Pre-tax

Amount

Tax

Benefit

Net

Amount

Pre-tax

Amount

Tax

(Benefit)

Expense

Net

Amount

Pre-tax

Amount

Tax

Benefit

Net

Amount

(Dollars in Millions)

Minimum pension liability

adjustments ................... $ (25.2) $(10.2) $(15.0) $ (2.0) $ (0.8) $ (1.2) $(14.8) $(6.0) $(8.8)

Foreign currency translation

adjustments:

Unrealized gains (losses) ........ 1.6 — 1.6 (60.7) — (60.7) (25.9) — (25.9)

Less: reclassification adjustment

for net losses recognized during

theperiod ................... 48.9 — 48.9 — — — — — —

Unrealized losses on securities and

derivatives:

Unrealized holding losses ........ (162.6) (65.8) (96.8) (203.2) (82.2) (121.0) (351.0) (142.0) (209.0)

Less: reclassification adjustment

for net (gains) losses recognized

duringtheperiod ............. (162.8) (63.7) (99.1) 95.2 38.6 56.6 — — —

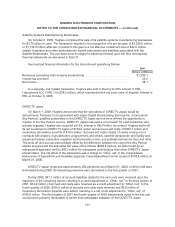

Note 13: Incentive Plans

Under the Hughes Electronics Corporation Incentive Plan (the “Plan”), as approved by the GM

Board of Directors in 1999, shares, rights or options to acquire up to 159 million shares of GM Class H

93