DIRECTV 2002 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note 1: Basis of Presentation and Description of Business

Hughes Electronics Corporation (“Hughes”) is a wholly-owned subsidiary of General Motors

Corporation (“GM”). The GM Class H common stock tracks the financial performance of Hughes.

Hughes is a leading provider of digital entertainment, information and communication services and

satellite-based private business networks. Hughes is the world’s leading digital multi-channel

entertainment service provider, based on the number of subscribers, with its programming distribution

service known as DIRECTV®, which was introduced in the United States (“U.S.”) in 1994 and was the

first high-powered, all digital, direct-to-home television distribution service in North America. DIRECTV

Broadband, Inc. (“DIRECTV Broadband”), formerly known as Telocity Delaware, Inc. (“Telocity”), which

was acquired by Hughes in April 2001, provided digital subscriber line (“DSL”) services purchased from

wholesale providers. DIRECTV Latin America, LLC, (“DLA”), which is 74.7% owned by Hughes, is the

leading direct-to-home satellite television service in Latin America and the Caribbean that began

service in 1996. Hughes is the owner and operator of one of the largest commercial satellite fleets in

the world through its approximately 81% owned subsidiary, PanAmSat Corporation (“PanAmSat”).

Hughes is also a leading provider of broadband services and products, including satellite wireless

communications ground equipment and business communications services. Hughes’ equipment and

services are applied in, among other things, data, video and audio transmission, cable and network

television distribution, private business networks, digital cellular communications and direct-to-home

satellite broadcast distribution of television programming.

Hughes announced, in December of 2002, that DIRECTV Broadband would close its high-speed

Internet service business in the first quarter of 2003 and transition existing customers to alternative

service providers. See further discussion of this item in Note 18.

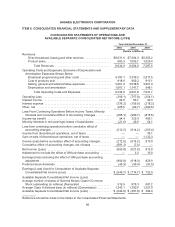

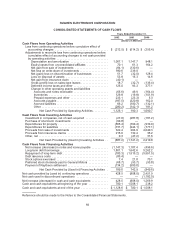

Revenues, operating costs and expenses, and other non-operating results for the discontinued

operations of the satellite systems manufacturing businesses (“Satellite Businesses”), which were sold

to The Boeing Company (“Boeing”) on October 6, 2000, are excluded from Hughes’ results from

continuing operations for 2000. Alternatively, the financial results are presented in Hughes’

Consolidated Statements of Operations and Available Separate Consolidated Net Income (Loss) in a

single line item entitled “Income from discontinued operations, net of taxes” and the net cash flows are

presented in the Consolidated Statements of Cash Flows as “Net cash used in discontinued

operations.” See further discussion in Note 18.

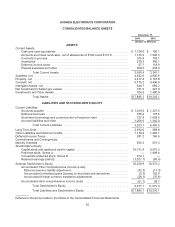

The accompanying consolidated financial statements include the applicable portion of intangible

assets, including goodwill, and related amortization resulting from purchase accounting adjustments

associated with GM’s purchase of Hughes in 1985, with certain amounts allocated to the Satellite

Businesses. With Hughes’ adoption of Statement of Financial Accounting Standards (“SFAS”) No. 142,

“Goodwill and Other Intangible Assets,” Hughes ceased amortization of goodwill and intangible assets

with indefinite lives on January 1, 2002. See further discussion in Note 3.

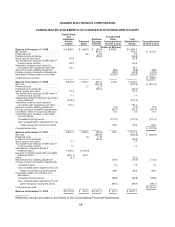

On October 28, 2001, Hughes and GM, together with EchoStar Communications Corporation

(“EchoStar”), announced the signing of definitive agreements that provided for the split-off of Hughes

from GM and the subsequent merger of the Hughes business with EchoStar (the “Merger”). Hughes,

GM and EchoStar entered into a termination agreement on December 9, 2002, pursuant to which GM,

70