DIRECTV 2002 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

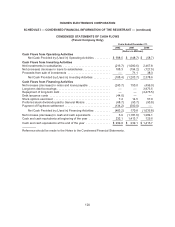

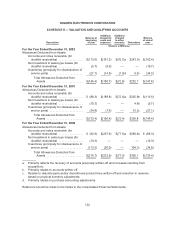

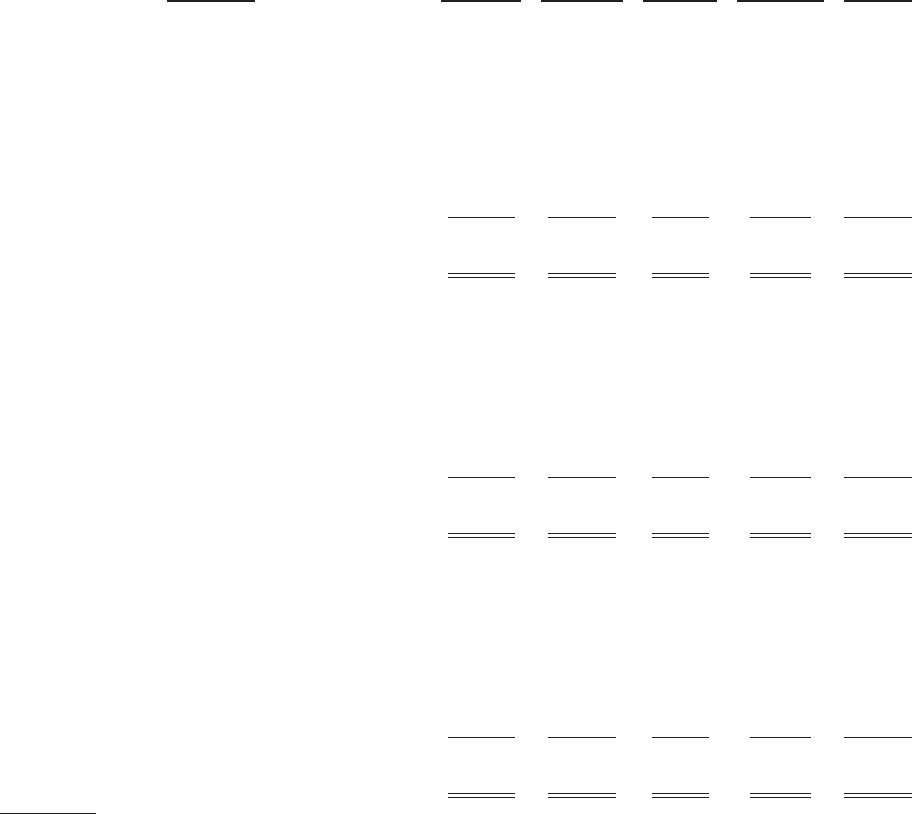

HUGHES ELECTRONICS CORPORATION

SCHEDULE II — VALUATION AND QUALIFYING ACCOUNTS

Description

Balance at

beginning

of year

Additions

charged to

costs and

expenses

Additions

charged

to other

accounts Deductions

Balance

at end of

year

(Dollars in Millions)

For the Year Ended December 31, 2002

Allowances Deducted from Assets

Accounts and notes receivable (for

doubtful receivables) ................ $(113.6) $(161.2) $(70.7)a $243.1b $(102.4)

Net investment in sales-type leases (for

doubtful receivables) ................ (5.7) (5.0) — — (10.7)

Inventories (principally for obsolescence of

serviceparts) ...................... (27.1) (14.5) (1.9)d 9.0c (34.5)

Total Allowances Deducted from

Assets ........................ $(146.4) $(180.7) $(72.6) $252.1 $(147.6)

For the Year Ended December 31, 2001

Allowances Deducted from Assets

Accounts and notes receivable (for

doubtful receivables) ................ $ (88.3) $(188.8) $(72.4)a $235.9b $(113.6)

Net investment in sales-type leases (for

doubtful receivables) ................ (10.3) — — 4.6b (5.7)

Inventories (principally for obsolescence of

serviceparts) ...................... (34.8) (7.6) — 15.3c (27.1)

Total Allowances Deducted from

Assets ........................ $(133.4) $(196.4) $(72.4) $255.8 $(146.4)

For the Year Ended December 31, 2000

Allowances Deducted from Assets

Accounts and notes receivable (for

doubtful receivables) ................ $ (92.9) $(207.9) $(77.9)a $290.4b $ (88.3)

Net investment in sales-type leases (for

doubtful receivables) ................ (10.3) — — — (10.3)

Inventories (principally for obsolescence of

serviceparts) ...................... (113.5) (26.0) — 104.7c (34.8)

Total Allowances Deducted from

Assets ........................ $(216.7) $(233.9) $(77.9) $395.1 $(133.4)

a. Primarily reflects the recovery of accounts previously written-off and increases resulting from

acquisitions.

b. Primarily relates to accounts written-off.

c. Relates to obsolete parts and/or discontinued product lines written-off and reduction in reserves

based on physical inventory adjustments.

d. Primarily relates to purchase accounting adjustments.

Reference should be made to the Notes to the Consolidated Financial Statements.

122