DIRECTV 2002 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

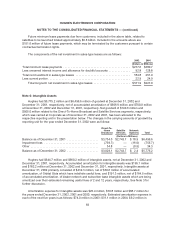

or in combination with other assets or liabilities, apart from selling the entire DIRECTV business. As a

result, in the first quarter of 2002, Hughes reclassified $209.8 million, net of $146.0 million of

accumulated amortization, of previously reported intangible assets to goodwill. As a result of this

reclassification, approximately $13.2 million of quarterly amortization expense ceased, beginning

January 1, 2002. In October 2002, Emerging Issues Task Force (“EITF”) Issue No. 02-17, “Recognition

of Customer Relationship Intangible Assets Acquired in a Business Combination” was issued, which

gave clarifying guidance on the treatment of certain subscriber-related relationships. As a result, as of

the beginning of the fourth quarter of 2002, the subscriber base and dealer network intangible assets

were reinstated and are being amortized over their estimated remaining useful lives of 2 and 12 years,

respectively. As a result of this change, Hughes recognized amortization expense of $18.5 million in

the fourth quarter of 2002.

In the first quarter of 2002, Hughes also completed the required transitional impairment test for

intangible assets with indefinite lives, which consist of Federal Communications Commission licenses

for direct-to-home broadcasting frequencies (“Orbital Slots”), and determined that no impairment

existed because the fair value of these assets exceeded the carrying value as of January 1, 2002.

In the second quarter of 2002, with the assistance of an independent valuation firm, Hughes

completed step one of the transitional test to determine whether a potential impairment existed for

goodwill recorded at January 1, 2002. Primarily based on the present value of expected future cash

flows, it was determined that the fair values of DIRECTV U.S. and the Satellite Services segment

exceeded their carrying values, therefore no further impairment test was required. It was also

determined that the carrying values of DLA and DIRECTV Broadband exceeded their fair values,

therefore requiring step two of the impairment test be performed. No goodwill or intangible assets

existed at the Network Systems segment and therefore no impairment test was required.

Hughes completed step two of the impairment test for DLA and DIRECTV Broadband in the fourth

quarter of 2002 as required by SFAS No. 142. Step two of the transitional test requires the comparison

of the implied value of the reporting unit goodwill with the carrying amount of that goodwill. If the

carrying amount of reporting unit goodwill exceeds the implied fair value of that goodwill, an impairment

loss will be recognized in an amount equal to that excess. In the initial year of adoption, the impairment

loss, if any, is recorded as a cumulative effect of accounting change, net of taxes. As a result of

completing step two, Hughes determined that $631.8 million and $107.9 million representing all of the

goodwill recorded at DLA and DIRECTV Broadband, respectively, was impaired. In addition, Hughes

also recorded a $16.0 million charge representing its share of the goodwill impairment of an equity

method investee. Therefore, Hughes recorded a cumulative effect of accounting change, net of taxes,

of $681.3 million ($755.7 million pre-tax) as of January 1, 2002 in the Consolidated Statements of

Operations and Available Separate Consolidated Net Income (Loss).

In accordance with SFAS No. 142, Hughes will perform its annual impairment test for all reporting

units during the fourth quarter of each year, commencing in the fourth quarter of 2002. If an impairment

loss results from the annual impairment test, the loss will be recorded as a pre-tax charge to operating

income. In the fourth quarter of 2002, with the assistance of an independent valuation firm, Hughes

completed its first annual impairment test for DIRECTV U.S. and the Satellite Services segment. The

independent valuation, which was primarily based on the present value of expected future cash flows,

resulted in fair values for DIRECTV U.S. and for the Satellite Services segment that exceeded Hughes’

carrying values. As a result, no impairment loss existed for DIRECTV U.S. and the Satellite Services

segment for 2002.

79