DIRECTV 2002 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HUGHES ELECTRONICS CORPORATION

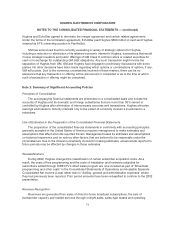

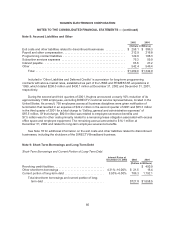

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

(“Pegasus”), arising from arrangements granting the NRTC and Pegasus the exclusive right to

distribute certain programming in certain areas. In addition, DLA provides services and extends credit

to unconsolidated local operating companies (“LOC’s) providing the DIRECTV service, particularly in

Venezuela and Puerto Rico. Management monitors its exposure to credit losses and maintains

allowances for anticipated losses.

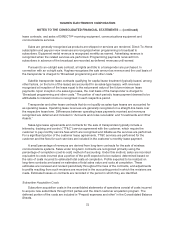

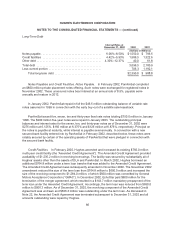

Note 3: Accounting Changes and New Accounting Standards

Accounting Changes

Hughes adopted SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”

on January 1, 2002. SFAS No. 144 refined existing impairment accounting guidance and extended the

use of this accounting to discontinued operations. SFAS No. 144 allowed the use of discontinued

operations accounting treatment for both reporting segments and distinguishable components thereof.

SFAS No. 144 also eliminated the existing exception to consolidation of a subsidiary for which control

is likely to be temporary. The adoption of SFAS No. 144 did not have any impact on Hughes’

consolidated results of operations or financial position. However, operating results of discontinued

businesses such as DIRECTV Broadband, which previously would not have been reported as a

discontinued operation, will be reported as a discontinued operation under this new standard in future

periods.

Hughes also adopted SFAS No. 142, “Goodwill and Other Intangible Assets” on January 1, 2002.

SFAS No. 142 required that existing and future goodwill and intangible assets with indefinite lives not

be amortized, but written-down, as needed, based upon an impairment analysis that must occur at

least annually, or sooner if an event occurs or circumstances change that would more likely than not

result in an impairment loss. All other intangible assets are amortized over their estimated useful lives.

SFAS No. 142 required that Hughes perform step one of a two-part transitional impairment test to

compare the fair value of each reportable unit with its respective carrying amount, including goodwill. If

the carrying value exceeds the fair value, step two of the transitional impairment test must be

performed to measure the amount of the impairment loss, if any. SFAS No. 142 also required that

intangible assets be reviewed as of the date of adoption to determine if they continue to qualify as

intangible assets under the criteria established under SFAS No. 141, “Business Combinations,” and to

the extent previously recorded intangible assets do not meet the criteria that they be reclassified to

goodwill.

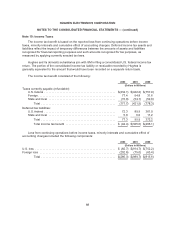

As part of Hughes’ acquisition of PRIMESTAR in 1999, dealer network and subscriber base

intangible assets were identified and valued in accordance with APB Opinion No. 16, “Business

Combinations.” The dealer network intangible asset originally valued as part of Hughes’ acquisition of

PRIMESTAR was based on established distribution, customer service and marketing capability that

had been put in place by PRIMESTAR. The subscriber base intangible asset originally valued as part

of Hughes’ acquisition of PRIMESTAR was primarily based on the expected non-contractual future

cash flows to be earned over the life of the PRIMESTAR subscribers converted to the DIRECTV

service. In accordance with SFAS No. 142, Hughes completed a review of its intangible assets and

determined that the previously recorded dealer network and subscriber base intangible assets

established under APB Opinion No. 16 did not meet the contractual or other legal rights criteria. The

dealer network and subscriber base intangible assets also did not meet the separability criteria

because the intangible assets could not be sold, transferred, licensed, rented or exchanged individually

78