DIRECTV 2002 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

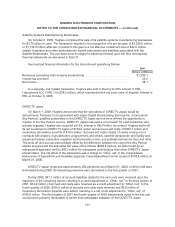

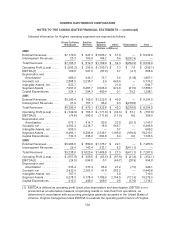

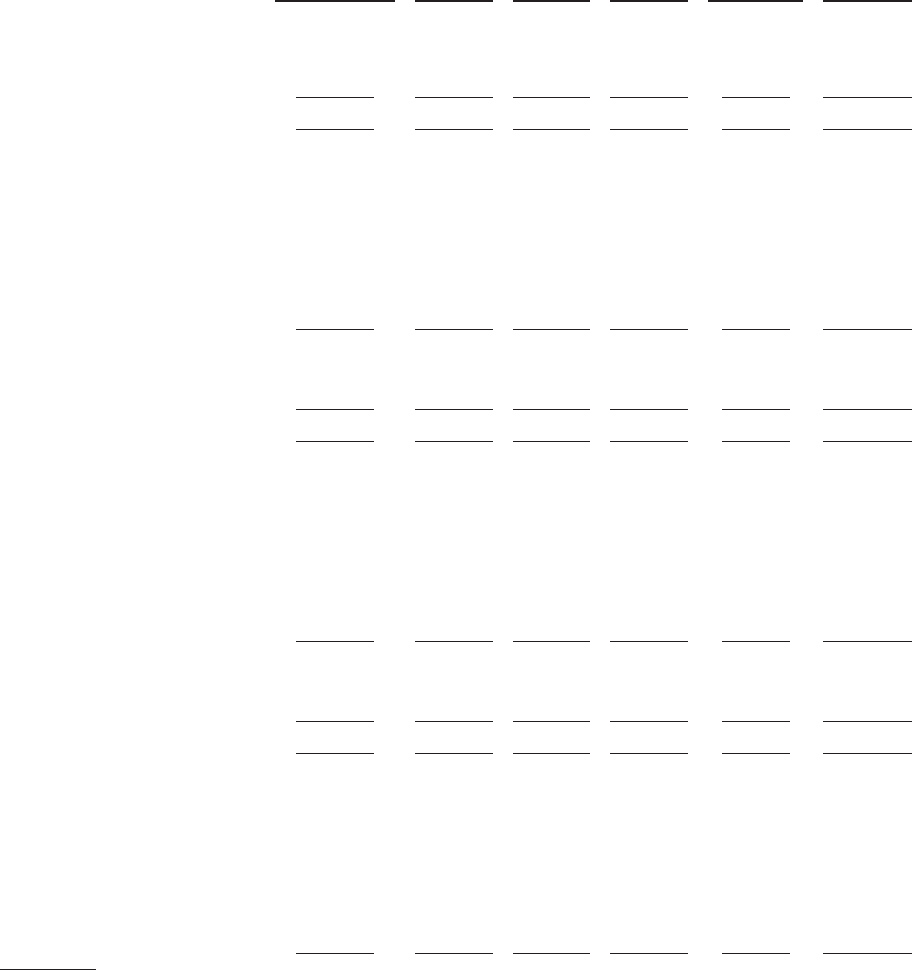

Selected information for Hughes’ operating segments are reported as follows:

Direct-To-Home

Broadcast

Satellite

Services

Network

Systems Other Eliminations Total

(Dollars in Millions)

2002

External Revenues ........ $7,170.0 $ 647.3 $1,065.7 $ 51.9 — $ 8,934.9

Intersegment Revenues .... 23.3 165.0 104.2 0.4 $(292.9) —

Total Revenues .......... $7,193.3 $ 812.3 $1,169.9 $ 52.3 $(292.9) $ 8,934.9

Operating Profit (Loss) ..... $ (505.2) $ 255.9 $ (160.7) $ 3.3 $ 7.6 $ (399.1)

EBITDA(1) .............. 160.8 591.6 (87.0) 6.7 (4.1) 668.0

Depreciation and

Amortization ........... 666.0 335.7 73.7 3.5 (11.8) 1,067.1

Goodwill, net ............. 2,888.5 2,238.7 2.4 645.6 — 5,775.2

Intangible Assets, net ..... 623.7 — — 21.0 — 644.7

Segment Assets .......... 7,957.2 6,487.7 2,526.9 974.8 (61.5) 17,885.1

Capital Expenditures ...... 524.1 294.3 400.4 0.1 79.2 1,298.1

2001

External Revenues ........ $6,285.4 $ 709.0 $1,229.6 $ 40.0 — $ 8,264.0

Intersegment Revenues .... 21.0 161.1 96.2 0.3 $(278.6) —

Total Revenues .......... $6,306.4 $ 870.1 $1,325.8 $ 40.3 $(278.6) $ 8,264.0

Operating Profit (Loss) ..... $ (749.9) $ 165.3 $ (171.8) $ (34.5) $ 33.1 $ (757.8)

EBITDA(1) .............. (74.8) 580.0 (111.8) (11.5) 8.0 389.9

Depreciation and

Amortization ........... 675.1 414.7 60.0 23.0 (25.1) 1,147.7

Goodwill, net ............. 3,593.3 2,238.7 18.9 645.7 — 6,496.6

Intangible Assets, net ..... 656.5 — — 3.7 — 660.2

Segment Assets .......... 9,484.1 6,296.8 2,339.1 1,199.0 (108.9) 19,210.1

Capital Expenditures ...... 734.3 338.2 664.6 0.4 6.0 1,743.5

2000

External Revenues ........ $5,208.6 $ 880.2 $1,176.7 $ 22.1 — $ 7,287.6

Intersegment Revenues .... 29.4 143.4 233.1 5.2 $(411.1) —

Total Revenues .......... $5,238.0 $1,023.6 $1,409.8 $ 27.3 $(411.1) $ 7,287.6

Operating Profit (Loss) ..... $ (557.9) $ 356.6 $ (63.5) $ (67.9) $ (21.4) $ (354.1)

EBITDA(1) .............. (24.5) 694.0 0.1 (46.7) (28.9) 594.0

Depreciation and

Amortization ........... 533.4 337.4 63.6 21.2 (7.5) 948.1

Goodwill, net ............. 3,432.4 2,303.6 41.6 663.2 — 6,440.8

Intangible Assets, net ..... 707.5 — — 3.0 — 710.5

Segment Assets .......... 9,278.3 6,178.4 1,789.9 2,154.0 (121.3) 19,279.3

Capital Expenditures ...... 913.5 449.5 369.5 0.6 (17.0) 1,716.1

(1) EBITDA is defined as operating profit (loss), plus depreciation and amortization. EBITDA is not

presented as an alternative measure of operating results or cash flow from operations, as

determined in accordance with accounting principles generally accepted in the United States of

America. Hughes management uses EBITDA to evaluate the operating performance of Hughes

104