DIRECTV 2002 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2002 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HUGHES ELECTRONICS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

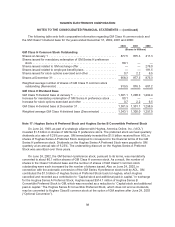

As more fully described in the Amended and Restated Certificate of Incorporation of Hughes, the

number of shares of Hughes Class B common stock that will be issued upon Optional Conversion will

be equal to the number of shares of Hughes Series B Convertible Preferred Stock converted, multiplied

by a fraction, the numerator of which is the stated value of the Hughes Series B Convertible Preferred

Stock ($1,000.00 per share) and the denominator of which is the Fair Market Value of a share of

Hughes Class B common stock (as determined in accordance with the Amended and Restated

Certificate of Incorporation of Hughes). Issuance of Hughes Class B common stock will have no impact

on the number of GM Class H common stock outstanding and no impact on the GM Class H dividend

base.

Note 18: Acquisitions and Divestitures

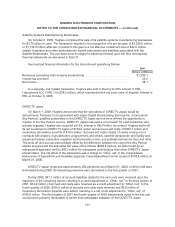

DIRECTV Broadband

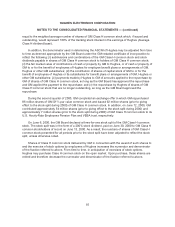

On April 3, 2001, Hughes acquired Telocity, a company that provides land-based DSL services,

through the completion of a tender offer and merger. Telocity was operated as DIRECTV Broadband

and is included as part of the Direct-To-Home Broadcast segment. The purchase price was

$197.8 million and was paid in cash. The following selected unaudited pro forma information is being

provided to present a summary of the combined results of Hughes and Telocity for 2001 and 2000 as if

the acquisition had occurred as of the beginning of the periods, giving effect to purchase accounting

adjustments. The pro forma data is presented for informational purposes only and may not necessarily

reflect the consolidated results of operations of Hughes had Telocity operated as part of Hughes for the

periods presented, nor are they necessarily indicative of the results of future operations. The pro forma

information excludes the effect of non-recurring charges.

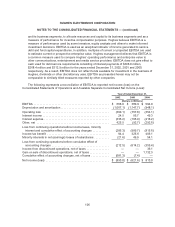

2001 2000

(Dollars in Millions)

Total revenues ....................................................... $8,272.1 $7,297.0

Income (loss) before cumulative effect of accounting change ................. (657.8) 670.0

Net income (loss) .................................................... (665.2) 670.0

Pro forma earnings (loss) used for computation of available separate

consolidated net income (loss) ........................................ (758.3) 589.9

On December 13, 2002, Hughes announced that DIRECTV Broadband would close its high-speed

Internet service business in the first quarter of 2003 and transition its existing customers to alternative

service providers. As a result, in December 2002, Hughes notified approximately half of DIRECTV

Broadband’s 400 employees of a layoff, with a minimum of 60 days notice during which time they were

paid, followed by receipt of a severance package. The remaining employees worked with customers

during the transition and assisted with the closure of the business, which occurred on February 28,

2003. As a result, Hughes recorded a fourth quarter 2002 charge of $92.8 million related to accruals for

employee severance benefits, contract termination payments and write-off of customer premise

equipment. This charge was recorded in “Selling, general and administrative expenses” in the

Consolidated Statements of Operations and Available Separate Consolidated Net Income (Loss).

Included in the $92.8 million charge were accruals for employee severance benefits of $21.3 million

and contract termination payments of $18.6 million. No amounts were paid as of December 31, 2002.

The financial information included herein reflects the acquisition discussed above from its date of

acquisition. The acquisition was accounted for by the purchase method of accounting and, accordingly,

99