Costco 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

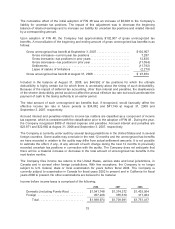

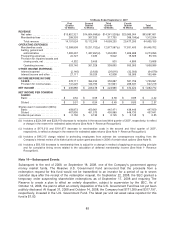

52 Weeks Ended September 2, 2007

First

Quarter

12 Weeks

Second

Quarter

12 Weeks

Third

Quarter

12 Weeks

Fourth

Quarter

16 Weeks

Total

52 Weeks

REVENUE

Net sales .................... $13,852,321 $14,804,696(b) $14,341,520(b) $20,089,064 $63,087,601

Membership fees ............. 299,303 307,320 317,735 388,196(e) 1,312,554

Total revenue .............. 14,151,624 15,112,016 14,659,255 20,477,260 64,400,155

OPERATING EXPENSES

Merchandise costs ............ 12,388,958 13,251,752(c) 12,877,587(c) 17,931,405 56,449,702

Selling, general and

administrative .............. 1,382,467 1,487,991(d) 1,432,650 1,969,988 6,273,096

Preopening expenses ......... 22,727 7,486 9,022 15,928 55,163

Provision for impaired assets and

closing costs, net ........... 4,332 3,459 931 4,886 13,608

Operating income ........... 353,140 361,328 339,065 555,053 1,608,586

OTHER INCOME (EXPENSE)

Interest expense .............. (2,140) (3,620) (26,016) (32,303) (64,079)

Interest income and other ...... 27,111 36,526 42,838 59,009 165,484

INCOME BEFORE INCOME

TAXES ...................... 378,111 394,234 355,887 581,759 1,709,991

Provision for income taxes ...... 141,225 144,756 131,901 209,337 627,219

NET INCOME .................. $ 236,886 $ 249,478 $ 223,986 $ 372,422 $ 1,082,772

NET INCOME PER COMMON

SHARE:

Basic ....................... $ 0.52 $ 0.55 $ 0.50 $ 0.85 $ 2.42

Diluted ...................... $ 0.51 $ 0.54 $ 0.49 $ 0.83 $ 2.37

Shares used in calculation (000’s)

Basic ....................... 458,873 450,901 445,471 438,449 447,659

Diluted ...................... 467,836 461,575 455,889 448,733 457,641

Dividends per share ............. $ 0.130 $ 0.130 $ 0.145 $ 0.145 $ 0.55

(b) Includes a $224,384 and $228,169 decrease to net sales in the second and third quarter of 2007, respectively, to reflect

a change in the reserve for estimated sales returns (See Note 1- Revenue Recognition).

(c) Includes a $176,313 and $181,977 decrease to merchandise costs in the second and third quarter of 2007,

respectively, to reflect a change in the reserve for estimated sales returns (See Note 1- Revenue Recognition).

(d) Includes a $46,215 charge related to protecting employees from adverse tax consequences resulting from the

Company’s internal review of its historical stock option grant practices in 2006 of certain stock options (See Note 6).

(e) Includes a $56,183 decrease to membership fees to adjust for a change in method of applying an accounting principle

and for cumulative timing errors related to the calculation of deferred membership income (See Note 1- Revenue

Recognition).

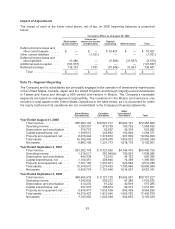

Note 14—Subsequent Events

Subsequent to the end of 2008, on September 18, 2008, one of the Company’s government agency

money market funds, The Reserve U.S. Government Fund announced that the proceeds from a

redemption request for this fund would not be transmitted to an investor for a period of up to seven

calendar days after the receipt of the redemption request. On September 22, 2008, the SEC granted a

temporary order suspending shareholder redemptions as of September 17, 2008 and requiring The

Reserve to create a plan to effect an orderly disposition, subject to supervision by the SEC. As of

October 14, 2008, the plan to effect an orderly disposition of the U.S. Government Fund has not yet been

publicly disclosed. At August 31, 2008 and October 14, 2008, the Company had $171,389 and $317,197,

respectively, invested in the U.S. Government Fund. The latest per unit net asset value reported for this

fund is $1.00.

85