Costco 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

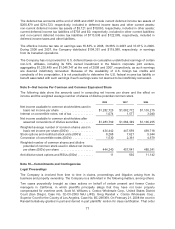

The accounting policies of the segments are the same as those described in Note 1. All inter-segment net

sales and expenses are immaterial and have been eliminated in computing total revenue and operating

income.

(a) Certain Home Office operating expenses are incurred on behalf of our Canadian operations, but are

included in the United States operations above as those costs are not allocated internally and generally

come under the responsibility of our United States management team.

(b) Includes a $39,200 charge related to protecting employees from adverse tax consequences resulting

from the Company’s internal review of its historical stock option grant practices in 2006 of certain stock

options (See Note 6).

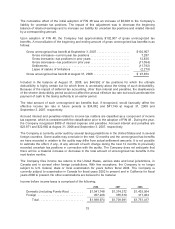

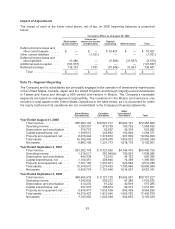

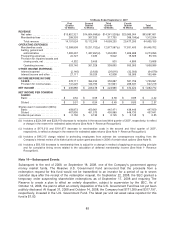

Note 13—Quarterly Financial Data (Unaudited)

The two tables that follow reflect the unaudited quarterly results of operations for 2008 and 2007.

52 Weeks Ended August 31, 2008

First

Quarter

12 Weeks

Second

Quarter

12 Weeks

Third

Quarter

12 Weeks

Fourth

Quarter

16 Weeks

Total

52 Weeks

REVENUE

Net sales ..................... $15,471,500 $16,616,962 $16,262,793 $22,626,229 $70,977,484

Membership fees .............. 338,030 342,924 350,924 473,658 1,505,536

Total revenue ............... 15,809,530 16,959,886 16,613,717 23,099,887 72,483,020

OPERATING EXPENSES

Merchandise costs ............. 13,823,511 14,833,189 14,548,022 20,298,028(a) 63,502,750

Selling, general and

administrative ............... 1,569,594 1,615,531 1,582,488 2,186,191 6,953,804

Preopening expenses .......... 21,492 9,699 8,427 17,765 57,383

Provision for impaired assets and

closing costs, net ............ 79 (2,865) 9,205 (6,171) 248

Operating income ............ 394,854 504,332 465,575 604,074 1,968,835

OTHER INCOME (EXPENSE)

Interest expense ............... (22,968) (23,471) (24,140) (32,057) (102,636)

Interest income and other ....... 33,277 40,604 23,888 35,006 132,775

INCOME BEFORE INCOME

TAXES ...................... 405,163 521,465 465,323 607,023 1,998,974

Provision for income taxes ...... 143,182 193,615 170,257 209,195 716,249

NET INCOME ................... $ 261,981 $ 327,850 $ 295,066 $ 397,828 $ 1,282,725

NET INCOME PER COMMON

SHARE:

Basic ........................ $ 0.60 $ 0.75 $ 0.68 $ 0.92 $ 2.95

Diluted ....................... $ 0.59 $ 0.74 $ 0.67 $ 0.90 $ 2.89

Shares used in calculation (000’s)

Basic ........................ 435,090 434,779 433,678 434,282 434,442

Diluted ....................... 445,717 444,925 443,281 443,874 444,240

Dividends per share .............. $ 0.145 $ 0.145 $ 0.160 $ 0.160 $ 0.61

(a) Includes a $32,316 increase to merchandise costs for a LIFO inventory adjustment (See Note 1- Merchandise

Inventories).

84