Costco 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Insurance/Self Insurance Liabilities

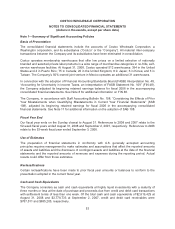

The Company uses a combination of insurance and self-insurance mechanisms, including a wholly-

owned captive insurance entity and participation in a reinsurance pool, to provide for potential liabilities

for workers’ compensation, general liability, property damage, director and officers’ liability, vehicle

liability and employee health care benefits. Liabilities associated with the risks that are retained by the

Company are not discounted and are estimated, in part, by considering historical claims experience

and evaluations of outside expertise, demographic factors, severity factors and other actuarial

assumptions. The estimated accruals for these liabilities could be significantly affected if future

occurrences and claims differ from these assumptions and historical trends. As of the end of 2008 and

2007, these insurance liabilities of $484,748 and $488,734, respectively, were included in accounts

payable, accrued salaries and benefits, and other current liabilities on the consolidated balance sheets,

classified based on their nature.

The Company’s wholly-owned captive insurance subsidiary participates in a reinsurance pool. The

member agreements and practices of the reinsurance pool limit any participating members’ individual

risk. Reinsurance revenues earned of $53,848, $50,897, and $67,589 during 2008, 2007, and 2006,

respectively, were primarily related to premiums received from the reinsurance pool. Reinsurance

costs of $53,628, $52,179 and $65,760 during 2008, 2007 and 2006, respectively, primarily related to

premiums paid to the reinsurance pool. Both revenues and costs are presented on a net basis in

selling, general and administrative expenses in the consolidated statements of income.

Derivatives

The Company follows Statement of Financial Accounting Standards (SFAS) No. 133, “Accounting for

Derivative Instruments and Hedging Activities (as amended)” (SFAS 133), in accounting for derivative

and hedging activities. The Company uses derivative and hedging arrangements only to manage what

it believes to be well-defined risks. Forward foreign exchange contracts are used to hedge the impact

of fluctuations of foreign exchange on inventory purchases and typically have very short terms. These

forward contracts do not qualify for derivative hedge accounting. The aggregate notional amount of

foreign exchange contracts outstanding at the end of 2008 and 2007 was $89,785 and $74,950,

respectively. The mark-to-market adjustment related to these contracts resulted in the recording of an

asset of $4,625 and a liability of $856 at the end of 2008 and 2007, respectively, and $5,758 and $358

were recognized in interest income and other in the consolidated statements of income in 2008 and

2007, respectively. The majority of the forward foreign exchange contracts were entered into by the

Company’s wholly-owned United Kingdom subsidiary primarily to hedge U.S. dollar merchandise

inventory purchases.

The Company is exposed to risks in energy costs due to fluctuations in energy prices, particularly

electricity, which it partially mitigates through the use of fixed-price contracts with counterparties for

approximately 19% of its warehouses in the U.S. and Canada, as well as certain depots and other

facilities. The Company has also entered into variable-priced contracts for the purchase of natural gas

and fuel for its gas stations on an index basis. These contracts qualify for treatment as “normal

purchase or normal sales” under SFAS 133 and require no mark-to-market adjustment.

Foreign Currency Translation

The functional currencies of the Company’s international subsidiaries are the local currency of the

country in which the subsidiary is located. Assets and liabilities recorded in foreign currencies, as well

as the Company’s investment in Costco Mexico, are translated at the exchange rate on the balance

sheet date. Translation adjustments resulting from this process are charged or credited to accumulated

other comprehensive income. Revenues and expenses of the Company’s consolidated foreign

57