Costco 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

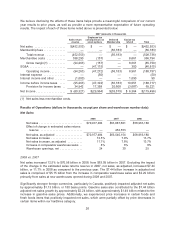

2008 vs. 2007

Membership fees increased 14.7% to $1.51 billion, or 2.12% of net sales in 2008, from $1.31 billion, or

2.08% of net sales in 2007. Excluding the adjustment to deferred membership fees in 2007, adjusted

membership fees increased 10.0% from 2007. The increase was primarily due to: new membership

sign-ups at the 24 new warehouses opened (34 opened and 10 closed due to relocations); increased

penetration of the higher-fee Executive Membership program; and the five dollar increase in our annual

membership fee in the second half of 2006 for non-Executive members. Our member renewal rate,

currently at 87%, is consistent with recent years.

2007 vs. 2006

Membership fees increased 10.5% to $1.31 billion, or 2.08% of net sales in 2007 from $1.19 billion, or

2.02% of net sales in 2006. Excluding the adjustment to deferred membership fees in 2007, adjusted

membership fees increased 15.2% from 2006. This increase was primarily due to: a five dollar increase

in our annual membership fee for our U.S. and Canada Gold Star (individual), Business and Business

Add-on members, which was effective May 1, 2006 for new members and July 1, 2006 for existing

members; increased penetration of the higher-fee Executive Membership program; and additional

membership sign-ups at the 30 new warehouses opened in 2007.

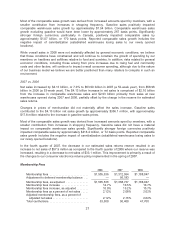

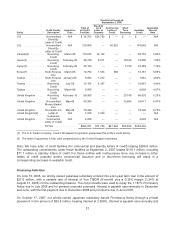

Gross Margin

2008 2007 2006

Gross margin ........................ $7,474,734 $6,637,899 $6,217,683

Unusual items ........................ — 85,759 —

Gross margin, as adjusted .............. $7,474,734 $6,723,658 $6,217,683

Gross margin increase ................. 12.6% 6.8% 12.4%

Gross margin increase, as adjusted ...... 11.2% 8.1% 12.4%

Gross margin as a percent of net sales . . . 10.53% 10.52% 10.55%

Adjusted gross margin as a percent of

adjusted net sales .................. 10.53% 10.58% 10.55%

2008 vs. 2007

Gross margin was $7.47 billion, or 10.53% of net sales in 2008, compared to $6.64 billion, or 10.52%

of net sales in 2007. Excluding the unusual items affecting net sales and gross margin in 2007,

adjusted gross margin as a percent of adjusted net sales decreased five basis points in 2008 as

compared to 2007. This decrease was largely due to a net 12 basis point decrease in our warehouse

ancillary businesses, particularly in one-hour photo, tire shop and food services, partially offset by an

increase in our gasoline business; a $32.3 million, or five basis point LIFO charge, resulting from price

increases in certain food items and gasoline; and a three basis point decrease resulting from the

increased penetration of the Executive Membership two-percent reward program and increased

spending by Executive members. These decreases were partially offset by a net 15 basis point

increase from our merchandise departments, particularly fresh foods, food and sundries, Costco Online

and our international operations, partially offset by a decrease in softlines. We’ve experienced price

increases from our suppliers at an increased rate, which may continue. Those increases generally are

reflected in our selling prices, but to the extent they are not or are delayed, our gross margins will be

adversely affected.

28