Costco 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

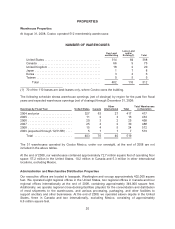

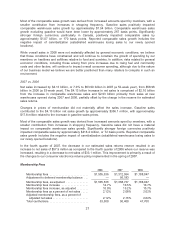

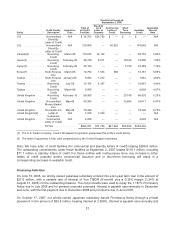

Preopening Expenses

2008 2007 2006

Preopening expenses ......................... $57,383 $55,163 $42,504

Warehouse openings .......................... 34 30 28

Relocations .................................. (10) — (3)

Warehouse openings, net of relocations .......... 24 30 25

Preopening expenses include costs incurred for startup operations related to new warehouses and the

expansion of ancillary operations at existing warehouses. Preopening expenses can vary due to the

timing of the opening relative to our year end, whether the warehouse is owned or leased, whether the

opening is in an existing, new or international market, as well as the number and magnitude of

warehouse remodel projects.

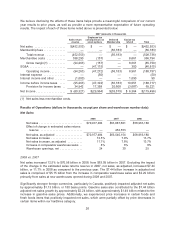

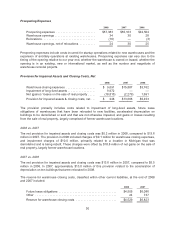

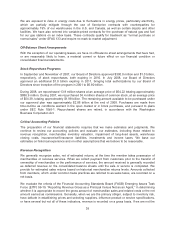

Provision for Impaired Assets and Closing Costs, Net

2008 2007 2006

Warehouse closing expenses ................... $ 9,091 $15,887 $3,762

Impairment of long-lived assets .................. 9,972 — —

Net (gains) / losses on the sale of real property ..... (18,815) (2,279) 1,691

Provision for impaired assets & closing costs, net . . . $ 248 $13,608 $5,453

The provision primarily includes costs related to impairment of long-lived assets, future lease

obligations of warehouses that have been relocated to new facilities, accelerated depreciation on

buildings to be demolished or sold and that are not otherwise impaired, and gains or losses resulting

from the sale of real property, largely comprised of former warehouse locations.

2008 vs. 2007

The net provision for impaired assets and closing costs was $0.2 million in 2008, compared to $13.6

million in 2007. The provision in 2008 included charges of $9.1 million for warehouse closing expenses,

and impairment charges of $10.0 million, primarily related to a location in Michigan that was

demolished and is being rebuilt. These charges were offset by $18.8 million of net gains on the sale of

real property, largely former warehouse locations.

2007 vs. 2006

The net provision for impaired assets and closing costs was $13.6 million in 2007, compared to $5.5

million in 2006. In 2007, approximately $13.0 million of this provision related to the acceleration of

depreciation on ten buildings that were relocated in 2008.

The reserve for warehouse closing costs, classified within other current liabilities, at the end of 2008

and 2007 included:

2008 2007

Future lease obligations ..................................... $4,505 $6,086

Other .................................................... 24 737

Reserve for warehouse closing costs .......................... $4,529 $6,823

30