Costco 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

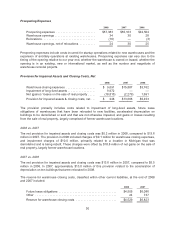

Interest Expense

2008 2007 2006

Interest expense ............................ $102,636 $64,079 $12,570

2008 vs. 2007

Interest expense totaled $102.6 million in 2008 compared to $64.1 million in 2007. The increase in

interest expense resulted primarily from the issuance of our $900 million of 5.3% and $1.1 billion of

5.5% Senior Notes (2007 Senior Notes) in February 2007, partially offset by lower interest expense

resulting from the repayment in March 2007 of the $300 Million 5.5% Senior Notes.

2007 vs. 2006

Interest expense totaled $64.1 million in 2007 compared to $12.6 million in 2006. The increase in

interest expense as compared to the prior year resulted primarily from the issuance of our 2007 Senior

Notes, partially offset by lower interest expense resulting from the repayment of the $300 Million 5.5%

Senior Notes in March 2007. In addition, interest expense decreased on the 3.5% Zero Coupon

Convertible Subordinated Notes (Zero Coupon Notes) as note holders converted approximately $61.2

million in principal amount of the Zero Coupon Notes into common stock, or $42.3 million after

factoring in the related debt discount.

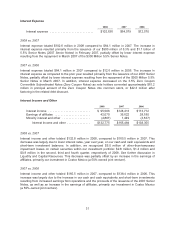

Interest Income and Other

2008 2007 2006

Interest income ........................... $ 95,506 $128,413 $113,712

Earnings of affiliates ....................... 42,070 35,622 28,180

Minority interest and other .................. (4,801) 1,449 (3,537)

Interest Income and other ............... $132,775 $165,484 $138,355

2008 vs. 2007

Interest income and other totaled $132.8 million in 2008, compared to $165.5 million in 2007. This

decrease was largely due to lower interest rates, year over year, on our cash and cash equivalents and

short-term investment balances. In addition, we recognized $5.0 million of other-than-temporary

impairment losses on certain securities within our investment portfolio: $2.8 million, $1.4 million and

$0.8 million in the second, third and fourth quarter, respectively of 2008. See further discussion in

Liquidity and Capital Resources. This decrease was partially offset by an increase in the earnings of

affiliates, primarily our investment in Costco Mexico (a 50%-owned joint venture).

2007 vs. 2006

Interest income and other totaled $165.5 million in 2007, compared to $138.4 million in 2006. This

increase was largely due to the increase in our cash and cash equivalents and short-term investments

resulting from increased earnings from operations and the proceeds of the issuance of the 2007 Senior

Notes, as well as an increase in the earnings of affiliates, primarily our investment in Costco Mexico

(a 50%-owned joint venture).

31