Costco 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

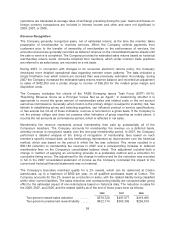

Merchandise Inventories

Merchandise inventories are valued at the lower of cost or market, as determined primarily by the retail

inventory method, and are stated using the last-in, first-out (LIFO) method for substantially all U.S.

merchandise inventories. Merchandise inventories for all other foreign operations are primarily valued

by the retail inventory method and are stated using the first-in, first-out (FIFO) method. The Company

believes the LIFO method more fairly presents the results of operations by more closely matching

current costs with current revenues. The Company records an adjustment each quarter, if necessary,

for the expected annual effect of inflation, and these estimates are adjusted to actual results

determined at year-end. The LIFO inventory adjustment in 2008 reduced ending inventory and gross

margin by $32,316. At the end of 2007, merchandise inventories valued at LIFO approximated FIFO

after considering the lower of cost or market principle.

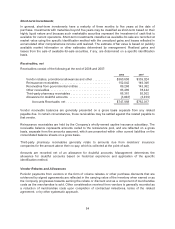

2008 2007

Merchandise inventories consist of:

United States (primarily LIFO) ............. $3,856,633 $3,799,999

Foreign (FIFO) .......................... 1,182,780 1,079,466

Total .............................. $5,039,413 $4,879,465

The Company provides for estimated inventory losses between physical inventory counts as a

percentage of net sales, using estimates based on the Company’s experience. The provision is

adjusted periodically to reflect the results of the actual physical inventory counts, which generally occur

in the second and fourth fiscal quarters of the fiscal year. Inventory cost, where appropriate, is reduced

by estimates of vendor rebates when earned or as the Company progresses towards earning those

rebates, provided that they are probable and reasonably estimable.

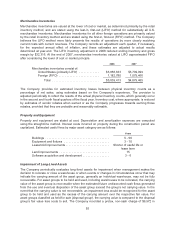

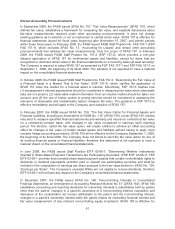

Property and Equipment

Property and equipment are stated at cost. Depreciation and amortization expenses are computed

using the straight-line method. Interest costs incurred on property during the construction period are

capitalized. Estimated useful lives by major asset category are as follows:

Years

Buildings ......................................... 5-50

Equipment and fixtures ............................. 3-10

Leasehold improvements ............................ Shorter of useful life or

lease term

Land improvements ................................ 15

Software acquisition and development ................. 3-6

Impairment of Long-Lived Assets

The Company periodically evaluates long-lived assets for impairment when management makes the

decision to relocate or close a warehouse or when events or changes in circumstances occur that may

indicate the carrying amount of the asset group, generally an individual warehouse, may not be fully

recoverable. For asset groups to be held and used, including warehouses to be relocated, the carrying

value of the asset group is recoverable when the estimated future undiscounted cash flows generated

from the use and eventual disposition of the asset group exceed the group’s net carrying value. In the

event that the carrying value is not recoverable, an impairment loss would be recognized for the asset

group to be held and used as the excess of the carrying amount over the respective fair value. For

asset groups classified as held for sale (disposal group), the carrying value is compared to the disposal

group’s fair value less costs to sell. The Company recorded a pretax, non-cash charge of $9,972 in

55