Costco 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The cumulative effect of the initial adoption of FIN 48 was an increase of $6,008 to the Company’s

liability for uncertain tax positions. The impact of this adjustment was to decrease the beginning

balance of retained earnings and to increase our liability for uncertain tax positions and related interest

by a corresponding amount.

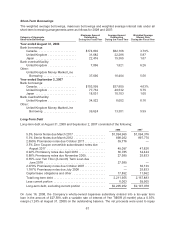

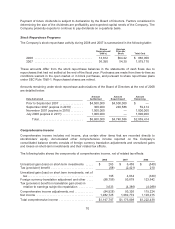

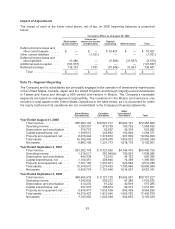

Upon adoption of FIN 48, the Company had approximately $102,907 of gross unrecognized tax

benefits. A reconciliation of the beginning and ending amount of gross unrecognized tax benefits is as

follows:

Gross unrecognized tax benefit at September 3, 2007 ..................... $102,907

Gross increases—current year tax positions ......................... 7,287

Gross increases—tax positions in prior years ........................ 12,830

Gross decreases—tax positions in prior year ......................... (11,094)

Settlements .................................................... (11,792)

Lapse of statute of limitations ..................................... (2,279)

Gross unrecognized tax benefit at August 31, 2008 ....................... $ 97,859

Included in the balance at August 31, 2008, are $44,992 of tax positions for which the ultimate

deductibility is highly certain but for which there is uncertainty about the timing of such deductibility.

Because of the impact of deferred tax accounting, other than interest and penalties, the disallowance

of the shorter deductibility period would not affect the annual effective tax rate but would accelerate the

payment of cash to the taxing authority to an earlier period.

The total amount of such unrecognized tax benefits that, if recognized, would favorably affect the

effective income tax rate in future periods is $34,862 and $41,749 at August 31, 2008 and

September 3, 2007, respectively.

Accrued interest and penalties related to income tax matters are classified as a component of income

tax expense, which is consistent with the classification prior to the adoption of FIN 48 . During the year,

the Company recognized $989 of interest expense and penalties. Accrued interest and penalties are

$23,871 and $22,882 at August 31, 2008 and September 3, 2007, respectively.

The Company is currently under audit by several taxing jurisdictions in the United States and in several

foreign countries. Some audits may conclude in the next 12 months and the unrecognized tax benefits

we have recorded in relation to the audits may differ from actual settlement amounts. It is not possible

to estimate the effect, if any, of any amount of such change during the next 12 months to previously

recorded uncertain tax positions in connection with the audits. The Company does not anticipate that

there will be a material increase or decrease in the total amount of unrecognized tax benefits in the

next twelve months.

The Company files income tax returns in the United States, various state and local jurisdictions, in

Canada and in several other foreign jurisdictions. With few exceptions, the Company is no longer

subject to U.S. federal, state or local examination for years before fiscal 2004. The Company is

currently subject to examination in Canada for fiscal years 2002 to present and in California for fiscal

years 2000 to present. No other examinations are believed to be material.

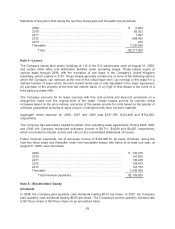

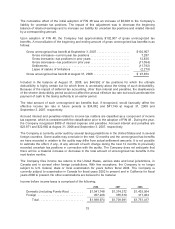

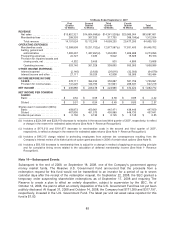

Income before income taxes is comprised of the following:

2008 2007 2006

Domestic (including Puerto Rico) ........ $1,541,748 $1,374,372 $1,433,954

Foreign ............................. 457,226 335,619 317,463

Total ............................ $1,998,974 $1,709,991 $1,751,417

75