Costco 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

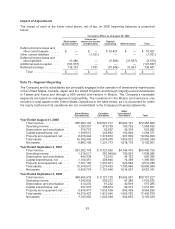

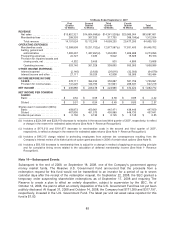

Impact of Adjustments

The impact of each of the items noted above, net of tax, on 2006 beginning balances is presented

below:

Cumulative Effect as of August 29, 2005

Stock option

grant practices

Income tax

reserve for excess

compensation

Deposit

accounting Deferred taxes Total

Deferred income taxes and

other current assets ....... $ — $ — $16,427 $ — $ 16,427

Other current liabilities ...... — (1,701) — — (1,701)

Deferred income taxes and

other liabilities ........... 31,480 — (6,383) (31,667) (6,570)

Additional paid-in-capital ..... (147,637) — — — (147,637)

Retained earnings .......... 116,157 1,701 (10,044) 31,667 139,481

Total ................. $ — $ — $ — $ — $ —

Note 12—Segment Reporting

The Company and its subsidiaries are principally engaged in the operation of membership warehouses

in the United States, Canada, Japan and the United Kingdom and through majority-owned subsidiaries

in Taiwan and Korea and through a 50%-owned joint-venture in Mexico. The Company’s reportable

segments are based on management responsibility. The investment in the Mexico joint-venture is only

included in total assets under United States Operations in the table below, as it is accounted for under

the equity method and its operations are not consolidated in the Company’s financial statements.

United States

Operations(a)

Canadian

Operations

Other

International

Operations Total

Year Ended August 31, 2008

Total revenue ................. $56,903,142 $10,527,777 $5,052,101 $72,483,020

Operating income ............. 1,393,351 419,759 155,725 1,968,835

Depreciation and amortization . . . 510,757 92,007 50,318 653,082

Capital expenditures, net ....... 1,189,615 245,862 163,094 1,598,571

Property and equipment, net .... 8,016,444 1,370,653 967,899 10,354,996

Total assets .................. 16,345,446 2,476,970 1,859,932 20,682,348

Net assets ................... 6,882,109 1,291,773 1,018,179 9,192,061

Year Ended September 2, 2007

Total revenue ................. $51,532,178 $ 8,723,562 $4,144,415 $64,400,155

Operating income ............. 1,216,517 287,045(b) 105,024 1,608,586

Depreciation and amortization . . . 449,338 72,915 44,132 566,385

Capital expenditures, net ....... 1,104,461 206,840 74,398 1,385,699

Property and equipment, net .... 7,357,160 1,237,031 925,589 9,519,780

Total assets .................. 15,576,673 2,279,453 1,750,460 19,606,586

Net assets ................... 6,450,774 1,157,640 1,014,927 8,623,341

Year Ended September 3, 2006

Total revenue ................. $48,465,918 $ 8,121,728 $3,563,581 $60,151,227

Operating income ............. 1,245,835 292,512 87,285 1,625,632

Depreciation and amortization . . . 413,235 61,232 40,818 515,285

Capital expenditures, net ....... 937,275 188,914 90,312 1,216,501

Property and equipment, net .... 6,676,417 1,032,439 855,439 8,564,295

Total assets .................. 14,015,423 1,913,945 1,565,702 17,495,070

Net assets ................... 7,195,992 1,043,384 904,063 9,143,439

83