Costco 2008 Annual Report Download - page 45

Download and view the complete annual report

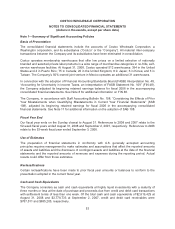

Please find page 45 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reporting period beginning on or after December 15, 2008, and interim periods within those fiscal

years. We must adopt these new requirements in our first quarter of fiscal 2010.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and

Hedging Activities—an Amendment of FASB Statement No. 133” (SFAS 161), which requires

enhanced disclosures about derivative and hedging activities. This statement is effective for financial

statements issued for periods beginning after November 15, 2008. Early adoption is permitted. We

must provide these new disclosures no later than our second quarter of fiscal 2009.

We are in the process of evaluating the impact that adoption of SFAS Nos. 141R, 160 and 161 will

have on our future consolidated financial statements.

Quantitative and Qualitative Disclosures About Market Risk

We are exposed to financial market risk resulting from changes in interest and foreign currency rates.

We do not engage in speculative or leveraged transactions, nor hold or issue financial instruments for

trading purposes. Recent developments in the financial markets, however, have rendered risks less

predictable, and liquidity concerns and credit risks have increased.

Our exposure to market risk for changes in interest rates relates primarily to our money market

funds, debt securities, corporate notes and bonds and enhanced money funds with effective maturities

of generally three months to five years at the date of purchase. The primary objective of our investment

activities is to preserve principal while generating yields without significantly increasing

risk. Historically, this was accomplished by investing in high investment grade securities with a

minimum overall portfolio average credit rating of AA-. A revised investment policy was approved in

December 2007 by our Board of Directors, limiting future investments to direct U.S. Government and

Government Agency obligations, repurchase agreements collateralized by U.S. Government and

Government Agency obligations and U.S. Government and Government Agency Money Market funds.

The investment policies of our subsidiaries have been reviewed and are consistent with our primary

objective to preserve principal while generating yields without significantly leveraging risk. Our wholly

owned insurance subsidiary invests in U.S. Government and Government Agency obligations,

corporate notes and bonds and asset and mortgage backed securities with a minimum overall portfolio

average credit rating of AA-.

All of our foreign subsidiaries’ investments are primarily in money market funds, investment grade

securities, bankers’ acceptances, bank certificates of deposit and term deposits all denominated in

their local currencies. Additionally, our Canadian subsidiary may invest a portion of their investments in

U.S. dollar investment grade securities and bank term deposits to meet current U.S. dollar obligations.

All of the investment policies of the Company and subsidiaries are reviewed at least annually.

As the majority of these investments in cash and cash equivalents are of a short-term nature, if interest

rates were to increase or decrease, there is no material risk of a material valuation adjustment related

to these instruments. Based on our cash and cash equivalents and short-term investment balances at

the end of 2008, a 100 basis point increase or decrease in interest rates would result in an increase or

decrease of approximately $17.9 million (pre-tax) to interest income on an annual basis. For those

investments that are classified as available-for-sale, the unrealized gains or losses related to

fluctuations in market volatility and interest rates are reflected within stockholders’ equity in

accumulated other comprehensive income.

The nature and amount of our long and short-term debt can be expected to vary as a result of future

business requirements, market conditions and other factors. As of the end of 2008, our fixed-rate long-

43