Costco 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

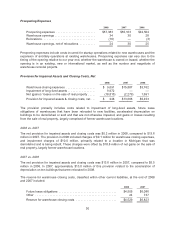

Provision for Income Taxes

2008 2007 2006

Income tax expense ....................... $716,249 $627,219 $648,202

Effective tax rate .......................... 35.83% 36.68% 37.01%

The effective income tax rate on earnings in 2008, 2007 and 2006 was 35.83%, 36.68% and 37.01%,

respectively. The lower tax rate in 2008 was primarily attributable to non-recurring benefits recognized

during the year.

Net Income

2008 2007 2006

Net income .......................... $1,282,725 $1,082,772 $1,103,215

Unusual items (net of tax) .............. — 119,496 —

Net income, as adjusted ............... $1,282,725 $1,202,268 $1,103,215

Diluted earnings per share ............. $ 2.89 $ 2.37 $ 2.30

Shares used to calculate diluted net

income per common share ........... 444,240 457,641 480,341

Diluted earnings per share increase ...... 22% 3% 6%

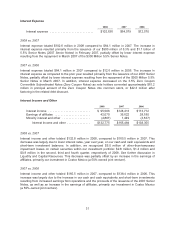

2008 vs. 2007

Net income for 2008 was $1.28 billion, or $2.89 per diluted share, compared to $1.08 billion, or $2.37

per diluted share, during 2007. The unusual items previously discussed totaled $119.5 million, net of

tax, or $0.26 per diluted share in 2007. Exclusive of these items, earnings in 2007 were $2.63 per

diluted share. Net income per diluted share in 2008 represents an increase of 10% over this adjusted

amount. During 2008, we repurchased and retired 13.8 million shares of common stock, favorably

impacting earnings per diluted share by approximately $0.03.

2007 vs. 2006

Net income for 2007 was $1.08 billion, or $2.37 per diluted share, compared to $1.10 billion, or $2.30

per diluted share during 2006. The unusual items previously discussed totaled $119.5 million, net of

tax, or $0.26 per diluted share in 2007. Exclusive of these items, earnings for 2007 were $2.63 per

diluted share, a 14% increase over the prior year. During 2007, we repurchased and retired

36.4 million shares of common stock, favorably impacting earnings per diluted share by approximately

$0.03.

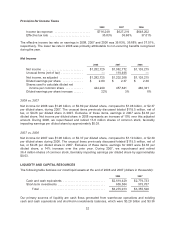

LIQUIDITY AND CAPITAL RESOURCES

The following table itemizes our most liquid assets at the end of 2008 and 2007 (dollars in thousands):

2008 2007

Cash and cash equivalents ........................... $2,619,429 $2,779,733

Short-term investments .............................. 655,584 575,787

Total .......................................... $3,275,013 $3,355,520

Our primary sources of liquidity are cash flows generated from warehouse operations and existing

cash and cash equivalents and short-term investments balances, which were $3.28 billion and $3.36

32