Costco 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

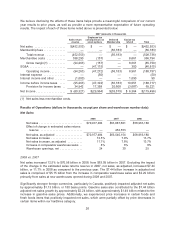

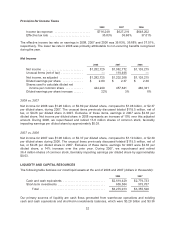

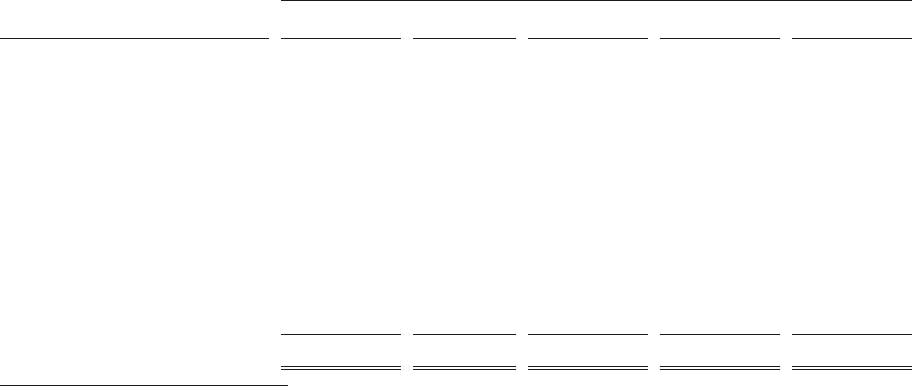

Contractual Obligations

Our commitments at year end to make future payments under contractual obligations were as follows,

as of August 31, 2008 (amounts in thousands):

Payments Due by Year

Contractual obligations 2009 2010 to 2011 2012 to 2013

2014 and

thereafter Total

Purchase obligations

(merchandise)(1) ......... $4,163,530 $ 1,693 $ — $ — $4,165,223

Long-term debt(2) .......... 110,735 285,140 1,072,608 1,505,387 2,973,870

Operating leases(3) ........ 139,916 277,885 247,634 1,438,390 2,103,825

Purchase obligations

(property, equipment,

services and other)(4) ..... 211,311 44,406 1,206 — 256,923

Construction

Commitments ........... 289,730 — — — 289,730

Capital lease obligations

and other(2) ............. 6,243 6,483 495 5,655 18,876

Other(5) .................. 15,723 4,406 2,405 6,113 28,647

Total ................. $4,937,188 $620,013 $1,324,348 $2,955,545 $9,837,094

(1) Includes open merchandise purchase orders.

(2) Includes contractual interest payments.

(3) Operating lease obligations exclude amounts commonly referred to as common area

maintenance, taxes and insurance and have been reduced by $149,468 to reflect sub-lease

income.

(4) The amounts exclude certain services negotiated at the individual warehouse or regional level that

are not significant and generally contain clauses allowing for cancellation without significant

penalty.

(5) Consists of asset retirement and deferred compensation obligations and includes $13,175 of

current unrecognized tax benefits relating to uncertain tax positions, but excludes $39,699 of

noncurrent unrecognized tax benefits due to uncertainty regarding the timing of future cash

payments.

Expansion Plans

Our primary requirement for capital is the financing of land, building and equipment costs for new and

remodeled warehouses. Capital is also required for initial warehouse operations and working capital.

While there can be no assurance that current expectations will be realized and plans are subject to

change upon further review, it is our current intention to spend approximately $1.7 billion during fiscal

2009 for real estate, construction, remodeling and equipment for warehouses and related operations.

These expenditures are expected to be financed with a combination of cash provided from operations

and existing cash and cash equivalents and short-term investments.

Plans for the United States and Canada during 2009 are to open approximately 24 to 28 new

warehouses, inclusive of one to three relocations of existing warehouses to larger and better-located

facilities. We expect to continue our review of expansion plans in our international operations, including

the United Kingdom and Asia, along with other international markets.

35