Costco 2008 Annual Report Download - page 82

Download and view the complete annual report

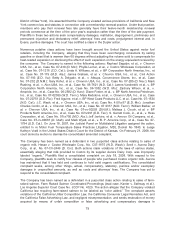

Please find page 82 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.unspecified amounts, injunctive relief remedying the allegedly improper disclosures, and costs and

attorneys’ fees. A California Superior Court ruling dismissing the action on the ground that federal law

does not permit claims for mislabeling of farm-raised salmon to be asserted by private parties was

reversed by the California Supreme Court; a petition seeking review by the United States Supreme

Court is pending. The Company has not yet responded to the complaint.

Two shareholder derivative lawsuits have recently been filed, ostensibly on behalf of the Company,

against certain of its current and former officers and directors, relating to the Company’s stock option

grants. One suit, Sandra Donnelly v. James Sinegal, et al., Case No. 08-2-23783-4 SEA (King County

Superior Court), was filed in Washington state court on or about July 17, 2008. Plaintiff alleges, among

other things, that individual defendants breached their fiduciary duties to the Company by “backdating”

grants of stock options issued between 1997 and 2005 to various current and former executives,

allegedly in violation of the Company’s shareholder-approved stock option plans. The complaint

asserts claims for unjust enrichment, breach of fiduciary duties, and waste of corporate assets, and

seeks damages, corporate governance reforms, an accounting, rescission of certain stock option

grants, restitution, and certain injunctive and declaratory relief, including the declaration of a

constructive trust for certain stock options and proceeds derived from the exercise of such options. The

Company has filed a motion to stay the lawsuit pending a decision by the Washington Supreme Court

in a separate proceeding.

The other action, Pirelli Armstrong Tire Corp. Retiree Medical Benefits Trust v. James Sinegal, et al.,

Case No. 2:08-cv-01450-TSZ (W.D. Wash.), was filed on or about September 29, 2008, and names as

defendants the Company’s directors and certain of its senior executives. Plaintiff alleges that

defendants approved the issuance of backdated stock options, concealed the backdating of stock

options, and refused to vindicate the Company’s rights by pursuing those who obtained improper

incentive compensation. The complaint asserts claims under both state law and the federal securities

laws and seeks relief comparable to that sought in the state court action described above. Plaintiff

further alleges that the misconduct occurred from at least 1997, and continued until 2006, and that as a

result virtually all of the Company’s SEC filings and financial and other public statements were false

and misleading throughout this entire period (including, but not limited to, each of the Company’s

annual financial statements for fiscal years 1997 through 2007 inclusive). Plaintiff alleges, among other

things, that defendants caused the Company to falsely represent that options were granted with

exercise prices that were not less than the fair market value of the Company’s stock on the date of

grant and issuance when they were not, to conceal that its internal controls and accounting controls

were grossly inadequate, and to grossly overstate its earnings. In addition, it is further alleged that

when the Company announced in October 2006 that it had investigated its historical option granting

practices and had not found fraud that announcement itself was false and misleading because, among

other reasons, it failed to report that defendants had consistently received options granted at monthly

lows for the grant dates and falsely suggested that backdating did not occur. Plaintiff also alleges that

false and misleading statements inflated the market price of the Company’s common stock and that

certain individual defendants sold, and the Company purchased, shares at inflated prices. The

defendants have yet to file any response to the Pirelli action.

On October 4, 2006, the Company received a grand jury subpoena from the United States Attorney’s

Office for the Central District of California, seeking records relating to the Company’s receipt and

handling of hazardous merchandise returned by Costco members and other records. The Company is

cooperating with the inquiry and at this time cannot reasonably estimate any loss that may arise from

this matter.

On March 15, 2007, the Company was informed by the U.S. Attorney’s Office in the Western District of

Washington that the office is conducting an investigation of the Company’s past stock option granting

practices to determine whether there have been any violations of federal law. As part of this

80