Costco 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Additional Equity Investments in Subsidiaries and Joint Ventures

The Company’s investments in the Costco Mexico joint venture and in other unconsolidated joint ventures

that are less than majority owned are accounted for under the equity method. In 2006, we contributed an

additional $15 million to our investment in Costco Mexico (a 50%-owned joint venture), which did not impact

our percentage ownership of this entity, as our joint venture partner contributed a like amount. There were

no such contributions in 2008 and 2007.

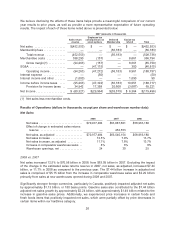

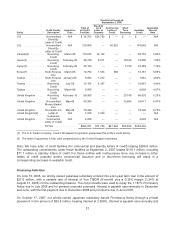

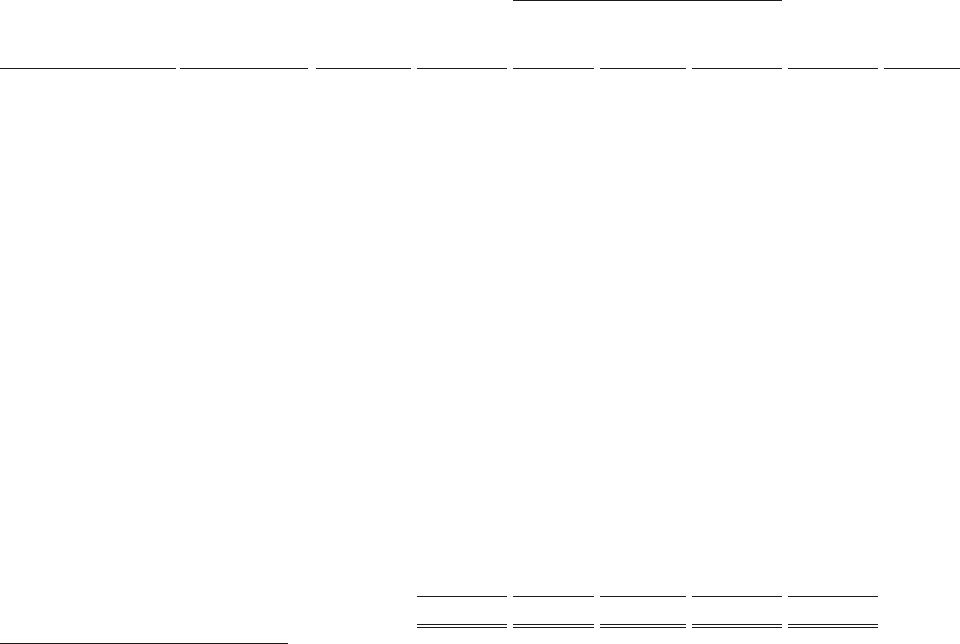

Bank Credit Facilities and Commercial Paper Programs (all amounts stated in thousands, in U.S.

dollars)

Credit Line Usage at

August 31, 2008

Entity

Credit Facility

Description

Expiration

Date

Total of

all Credit

Facilities

Stand-by

LC &

Letter of

Guaranty

Commercial

Letter of

Credit

Short

Term

Borrowing

Available

Credit

Applicable

Interest

Rate

U.S. ............... Uncommitted

Stand By

Letter of Credit

N/A $ 25,323 $25,323 $ — $ — $ — N/A

U.S. ............... Uncommitted

Commercial

Letter of Credit

N/A 160,000 — 45,463 — 114,537 N/A

Australia(1) ......... Guarantee Line N/A 8,622 2,656 — — 5,966 N/A

Canada(1, 3) ........ Multi-Purpose

Line

March-09 142,207 19,590 — 85,296 37,321 3.43%

Japan(1) ...........Revolving Credit February-09 32,187 — — 4,139 28,048 1.00%

Japan(1) ........... Bank Guaranty February-09 9,196 9,196 — — — N/A

Japan(1) ...........Revolving Credit February-09 32,187 — — 14,254 17,933 1.04%

Korea(1) ........... Multi-Purpose

Line

March-09 11,021 1,460 694 — 8,867 6.53%

Taiwan ............ Multi-Purpose

Line

January-09 15,853 4,772 2 — 11,079 4.50%

Taiwan ............ Multi-Purpose

Line

July-09 15,853 1,934 — — 13,919 4.59%

United Kingdom .....Revolving Credit February-10 73,144 — — — 73,144 5.67%

United Kingdom ..... Uncommitted

Money Market

May-09 36,572 — — 30,720 5,852 5.36%

United Kingdom ..... Overdraft Line May-09 64,001 — — — 64,001 6.00%

United Kingdom(2) . . . Letter of

Guarantee

N/A 3,651 3,651 — — — N/A

United Kingdom ..... Commercial

Letter of Credit

N/A 3,657 238 1,081 — 2,338 N/A

TOTAL ................... $633,474 $68,820 $47,240 $134,409 $383,005

(1) The U.S. Parent company, Costco Wholesale Corporation guarantees this entity’s credit facility.

(2) The letter of guarantee is fully cash-collateralized by the United Kingdom subsidiary.

(3) The amount shown for short-term borrowings under this facility is net of a note issue discount, which is excluded from

the available credit amount.

Note: We have letter of credit facilities (for commercial and standby letters of credit) totaling $238.9 million.

The outstanding commitments under these facilities at August 31, 2008 totaled $116.1 million, including

$68.8 million in standby letters of credit. For those entities with multi-purpose lines, any increase in either

letters of credit (standby and/or commercial) issuance and or short-term borrowing will result in a

corresponding decrease in available credit.

36