Costco 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

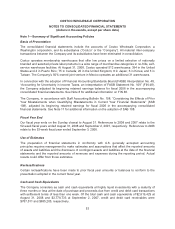

Merchandise Costs

Merchandise costs consist of the purchase price of inventory sold, inbound shipping charges and all

costs related to the Company’s depot operations, including freight from depots to selling warehouses,

and are reduced by vender consideration received. Merchandise costs also include salaries, benefits,

depreciation on production equipment, and other related expenses incurred by the Company’s cross-

docking depot facilities and in certain fresh foods and ancillary departments.

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist primarily of salaries, benefits and workers’

compensation costs for warehouse employees, other than fresh foods departments and certain

ancillary businesses, as well as all regional and home office employees, including buying personnel.

Selling, general and administrative expenses also include utilities, bank charges, rent and substantially

all building and equipment depreciation, as well as other operating costs incurred to support

warehouse operations.

Marketing and Promotional Expenses

Costco’s policy is generally to limit marketing and promotional expenses to new warehouse openings,

occasional direct mail marketing to prospective new members and direct mail marketing programs to

existing members promoting selected merchandise. Marketing and promotional costs are expensed as

incurred and are included in selling, general and administrative and preopening expenses in the

accompanying consolidated statements of income.

Preopening Expenses

Preopening expenses related to new warehouses, major remodels and expansions, new regional

offices and other startup operations are expensed as incurred.

Closing Costs

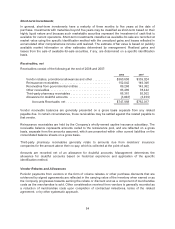

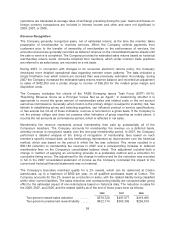

Warehouse closing costs incurred relate principally to the Company’s relocation of certain warehouses

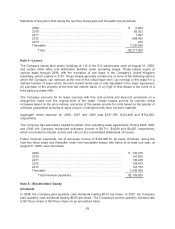

(that were not otherwise impaired) to larger and better-located facilities. The provisions for 2008, 2007

and 2006 included charges in the amounts indicated below:

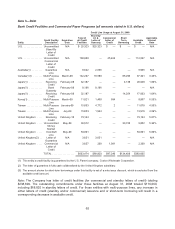

2008 2007 2006

Warehouse closing expenses ................... $ 9,091 $15,887 $3,762

Impairment of long-lived assets .................. 9,972 — —

Net (gains) losses on sale of real property ......... (18,815) (2,279) 1,691

Total .................................... $ 248 $13,608 $5,453

Warehouse closing expenses primarily relate to accelerated building depreciation and remaining lease

obligations, net of estimated sublease income, for leased locations. At the end of 2008, the Company’s

reserve for warehouse closing costs was $4,529 of which $4,505 related to future lease obligations.

This compares to a reserve for warehouse closing costs of $6,823 at the end of 2007, of which $6,086

related to future lease obligations.

Stock-Based Compensation

The Company adopted SFAS 123R, “Share-Based Payment (as amended)” (SFAS 123R) at the

beginning of 2006, which requires companies to measure all employee stock-based compensation

awards using a fair value method and record such expense in its consolidated financial statements.

See Note 6 for additional information on the Company’s stock-based compensation plans.

59