Costco 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

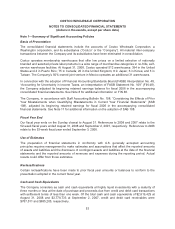

financial statements issued for fiscal years beginning after December 15, 2008, and interim periods

within those fiscal years. Early adoption is prohibited. The Company must adopt these new

requirements in its first quarter of fiscal 2010.

In December 2007, the FASB issued SFAS No. 141R, “Business Combinations” (SFAS 141R), which

establishes principles and requirements for the reporting entity in a business combination, including

recognition and measurement in the financial statements of the identifiable assets acquired, the

liabilities assumed, and any noncontrolling interest in the acquiree. SFAS 141R applies prospectively to

business combinations for which the acquisition date is on or after the beginning of the first annual

reporting period beginning on or after December 15, 2008, and interim periods within those fiscal

years. The Company must adopt these new requirements in its first quarter of fiscal 2010.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and

Hedging Activities—an Amendment of FASB Statement No. 133” (SFAS 161), which requires

enhanced disclosures about derivative and hedging activities. This statement is effective for financial

statements issued for fiscal periods beginning after November 15, 2008. Early adoption is permitted.

The Company must provide these new disclosures no later than its second quarter of fiscal 2009.

The Company is in the process of evaluating the impact that adoption of SFAS Nos. 160, 141R and

161 will have on its future consolidated financial statements.

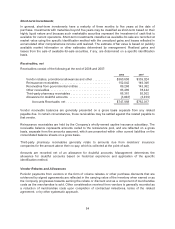

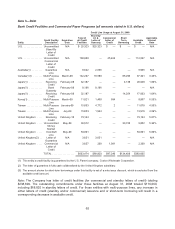

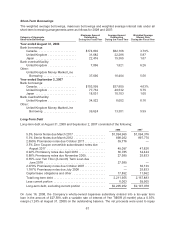

Note 2—Investments

Investments at August 31, 2008 and September 2, 2007, were as follows:

Cost Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

Balance Sheet

Classification

2008:

Short-term

Investments

Other

Assets

Available-for-sale:

Money market mutual

funds ................ $ 16,208 $ — $ — $ 16,208 $ 16,208 $ —

U.S. Government and

agency securities ...... 354,968 1,586 (772) 355,782 355,782 —

Corporate notes and

bonds ............... 114,863 1,058 (1,053) 114,868 99,044 15,824

Asset and mortgage

backed securities ...... 113,078 481 (2,360) 111,199 84,052 27,147

Total

available-for-sale . . 599,117 3,125 (4,185) 598,057 555,086 42,971

Held-to-maturity:

Certificates of deposit .... 460 — — 460 460 —

Enhanced money funds . . 125,089 — — 125,089 100,038 25,051

Total

held-to-maturity . . . 125,549 — — 125,549 100,498 25,051

Total investments . . $724,666 $3,125 $(4,185) $723,606 $655,584 $68,022

62