Costco 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

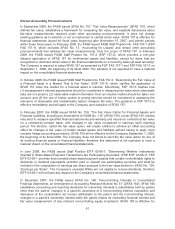

In December 2007, one of the Company’s enhanced money fund investments, Columbia Strategic

Cash Portfolio Fund (Columbia), ceased accepting cash redemption requests and changed to a

floating net asset value. In light of the restricted liquidity, the Company elected to receive a pro-rata

allocation of the underlying securities in a separately managed account. The Company assessed the

fair value of the underlying securities in this account through market quotations and review of current

investment ratings, as available, coupled with an evaluation of the liquidation value of each investment

and its current performance in meeting scheduled payments of principal and interest. In 2008, the

Company recognized $5,033 of other-than-temporary losses related to these securities: $2,773, $1,431

and $829 in the second, third and fourth quarters, respectively. The losses are included in interest

income and other in the accompanying consolidated statements of income. At the end of 2008, the

balance of the Columbia fund was $103,641 on the consolidated balance sheet.

Additionally, in December 2007, two other enhanced money fund investments, BlackRock Cash

Strategies, LLC (BlackRock) and Merrill Lynch Capital Reserve Fund, LLC (Merrill Lynch), ceased

accepting redemption requests. These two funds are being liquidated with periodic distributions and

the expectation is that the funds will be substantially liquidated by 2010. To date, the funds have

maintained a $1.00 per unit net asset value. At the end of 2008, the combined balance of BlackRock

and Merrill Lynch funds was $125,089 on the consolidated balance sheet. The Company received cash

redemptions of $48,212 from the BlackRock and Merrill Lynch funds subsequent to the end of the year

and through October 14, 2008.

During 2008, the Company reclassified $371,062 related to these three funds from cash and cash

equivalents. This reclassification is shown in cash flows from investing activities in the consolidated

statements of cash flows. At the end of 2008, $228,730 remained, with $160,708 in short-term

investments and $68,022 in other assets on the consolidated balance sheet, reflecting the timing of the

expected distributions.

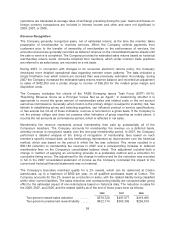

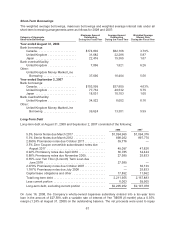

The maturities of available-for-sale and held-to-maturity debt securities at August 31, 2008 are as

follows:

Available-For-Sale Held-To-Maturity

Cost Basis Fair Value Cost Basis Fair Value

Due in one year or less .................... $385,888 $386,049 $125,549 $125,549

Due after one year through five years ........ 210,682 209,574 — —

Due after five years ....................... 2,547 2,434 — —

$599,117 $598,057 $125,549 $125,549

64