Costco 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

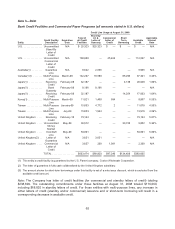

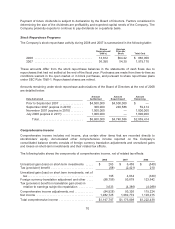

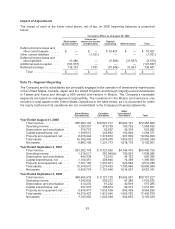

Summary of Stock-Based Compensation

The following table summarizes stock-based compensation and the related tax benefits under the

Company’s plans:

2008 2007 2006

Restricted stock units ................................. $ 97,460 $ 51,626 $ 4,924

Stock options ....................................... 68,645 82,956 102,473

Incremental expense related to modification of certain stock

options ........................................... — 8,072 —

Total stock-based compensation expense before income

taxes ............................................ 166,105 142,654 107,397

Income tax benefit ................................... (54,969) (47,096) (34,288)

Total stock-based compensation expense, net of income

tax .............................................. $111,136 $ 95,558 $ 73,109

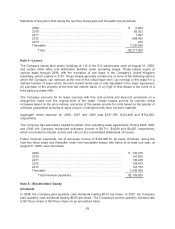

The remaining unrecognized compensation cost related to non-vested RSUs at August 31, 2008, was

$296,755, and the weighed-average period of time over which this cost will be recognized is 3.6 years.

The remaining unrecognized compensation cost related to unvested stock options at August 31, 2008,

was $70,076, and the weighted-average period of time over which this cost will be recognized is 1.4

years.

Note 7—Retirement Plans

The Company has a 401(k) Retirement Plan that is available to all U.S. employees who have

completed 90 days of employment. For all U.S. employees, with the exception of California union

employees, the plan allows pre-tax deferrals against which the Company matches 50% of the first one

thousand dollars of employee contributions. In addition, the Company provides each eligible participant

an annual contribution based on salary and years of service.

California union employees participate in a defined benefit plan sponsored by their union. The

Company makes contributions based upon its union agreement. For all the California union

employees, the Company-sponsored 401(k) plan currently allows pre-tax deferrals against which the

Company matches 50% of the first five hundred dollars of employee contributions. In addition, the

Company will provide each eligible participant a contribution based on hours worked and years of

service.

The Company has a defined contribution plan for Canadian and United Kingdom employees and

contributes a percentage of each employee’s salary. The Company complies with government

requirements related to retirement benefits for other international operations and accrues expenses

based on a percentage of each employee’s salary as appropriate.

Amounts expensed under all plans were $271,576, $238,826 and $233,595 for 2008, 2007 and 2006,

respectively. The Company has defined contribution 401(k) and retirement plans only, and thus has no

liability for post-retirement benefit obligations.

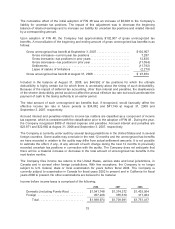

Note 8—Income Taxes

Effective September 3, 2007, the Company adopted FIN 48, which clarified the accounting for

uncertainty in income taxes recognized in financial statements. FIN 48 prescribes a recognition

threshold and measurement attribute for the financial statement recognition and measurement of a tax

position taken or expected to be taken in a tax return. FIN 48 also provides guidance on derecognition,

classification, interest and penalties, accounting in interim periods, disclosure and transition.

74