Costco 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.disposition of the U.S. Government Fund has not yet been publicly disclosed. At August 31, 2008 and

October 14, 2008, we had $171.4 million and $317.2 million, respectively, invested in the fund.

Although market conditions cannot be predicted, we currently do not expect to realize a loss on this

fund. The latest per unit net asset value reported for the fund is $1.00.

Subsequent to the end of 2008, Lehman Brothers Holdings Inc. (Lehman) filed a petition under

Chapter 11 of the U.S. Bankruptcy Code. At August 31, 2008, we held $2.3 million of Lehman

securities, within the Columbia portfolio, purchased by the fund manager prior to receipt of our pro-rata

allocation of the fund’s investments in December 2007. As of October 14, 2008, we do not have an

estimate of the recovery value of the Lehman securities.

Additionally, on September 29, 2008, one of Sigma Finance Corporation’s (Sigma) lenders terminated

its repurchase agreements, followed by two additional lenders also terminating agreements. On

September 30, 2008 Sigma received a notice of default, which is expected to cause lenders to move to

seize Sigma’s assets. Sigma’s Board of Directors also announced they will cease trading. At

August 31, 2008, we held Sigma securities with a market value of $2.2 million and a book value of $1.9

million, within the Columbia portfolio purchased by the fund manager prior to receipt of our pro-rata

allocation of the fund’s investments in December 2007. These securities were previously impaired

during 2008 and $1.4 million was recorded as an other-than-temporary impairment. As of October 14,

2008, we do not have an estimate of the recovery value of these securities.

Although future market conditions cannot be predicted, we currently do not expect future losses in our

investment portfolio to be material to our consolidated financial statements or that we will experience a

detriment to our overall liquidity.

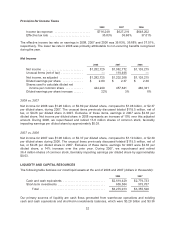

Net cash used in financing activities totaled $613.0 million in 2008 compared to $164.6 million in 2007.

The $448.4 million increase in net cash used in financing activities primarily resulted from a net

decrease in cash provided by the issuance of long-term debt, net of repayments, of $1.65 billion,

largely relating to the issuance of the 2007 Senior Notes. This decrease was partially offset by a

reduction in the repurchase of common stock of $1.08 billion, and an increase in the net proceeds from

short-term borrowings of $76.7 million.

Dividends

In April 2008, our Board of Directors increased our quarterly cash dividend from $0.145 to $0.16 per

share or $0.64 on an annualized basis. Our quarterly cash dividends paid in 2008 totaled $0.61 per

share. In 2007, we paid quarterly cash dividends totaling $0.55 per share.

34